Tracking organic search performance is about to get comically frustrating.

Google has been rolling out a series of AI-enhanced search results over the past 18 months:

SEO professionals are battling to determine the extent to which they are stealing visibility and traffic.

To further complicate our jobs, more people are using AI search tools like ChatGPT, Perplexity, Copilot, Claude and Gemini for search-related tasks.

We must ask ourselves if the volume of these other search channels requires a serious content investment or whether we should wait.

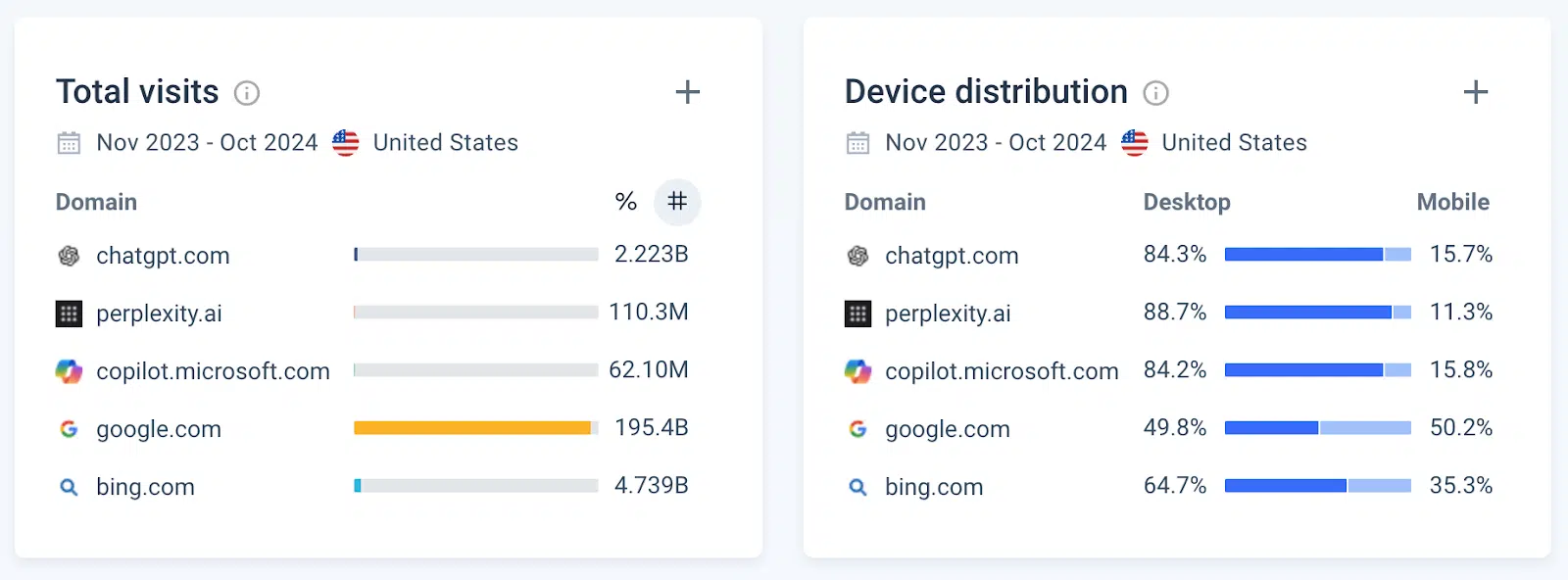

ChatGPT has about 50 times more web traffic than Perplexity and Copilot, but it is insignificant compared to Google, according to Similarweb.

But that doesn’t take into account ChatGPT app usage. Regardless, ChatGPT’s traffic has grown exponentially over the past year.

Now’s an opportune time to plan a content strategy, assuming that its deals with various publishers and integration into the Apple ecosystem will lead to a semi-permanent competitive presence in the organic search market going forward.

Are people using AI search for shopping?

A few weeks ago, Google Shopping got a complete AI overhaul. ChatGPT added its search feature. Perplexity now has a purchase button directly on the results page for Pro customers.

Buying holiday gifts used to involve a family trip to the mall. It was a physical experience.

People would line up at 5 a.m. Friday morning at their favorite retail store to get first dibs on the trendiest electronics, clothing, or toys. There was something gladiatorial about it.

Now, we can do it all from our phones. AI search will either remove all of the “humanity” out of shopping for your loved ones or make the experience more personalized and special than our lazy humans are capable of.

Imagine being able to run an AI search with a list of your best friend’s interests, a budget and the most recent trends.

You get a selection of gifts that would make them feel loved, appreciated and seen – the pure fantasy of the lazy gift giver.

However, with these AI search developments, not only is it a stronger reality, but brands also need to figure out ways to appear in the results and, at the very least, track their visibility.

Tracking brand mentions AI search channels

Assuming that more people are searching for gifts using AI search tools (there’s no definitive data yet), how should marketers track their brand’s visibility in these black box channels?

We need to accept that search volume and keyword tracking in conversational search is an unsolved problem.

As search becomes conversational, we use more natural language, our searches become longer and the results are more contextual and personalized.

I discussed the challenges of conversational search bias in the context of Google’s AI-organized search results at length recently in a virtual presentation:

Despite feeling like an inexact science, tools have started tracking AI Overviews.

Others have emerged to attempt to surface insights from the conversational AI search mess.

The most compelling tool we’ve encountered is Profound. (Disclosure: Profound has provided me access to their tool and worked with me to run some experiments.)

Instead of focusing on a keyword, Profound uses topics to generate several prompts with subtopic variations, run them multiple times and identify which brands are being recommended by the AI search tools.

The topical approach offers a bird’s-eye view of brand performance despite the limitations of minimal-volume long-tail keyword search utility.

Over time, you can identify trends in your industry by topic, brand, and publication.

Once you identify the types of citations included in the AI search output, you can create your digital PR and content strategy to improve visibility in conversational search.

Anecdotally, the Profound team has already noticed some of these trends in conversational search behavior.

According to Josh Blyskal, Customer Success Lead at Profound:

- People put a lot of trust in AI. They provide elaborate detail in their prompts and ask AI for help with very important decisions.

- People are making high purchase intent queries in AI, although the ability to purchase with AI is still new. People are going to AI search for recommendations, with many purchases still going back through Google.

- AI loves mentioning brand names, regardless of whether a brand is included in the prompt. There are some brands that AI can’t stop talking about. This means that as AI usage grows, some brands will have a big marketing head start. Now is the best/easiest time to become one of these brands because the competition is the sparsest.

So, assuming that people use conversational AI to find brands and products, but the searches are unique and insignificant in volume, how do you monitor mentions and visibility?

Using topics for search instead of keywords

Topic clusters have been a popular content strategy for SEO.

Many websites already attempt to blanket a topic methodically by making sure they cover every nook and cranny that could be searched for by their audience.

Having a comprehensive and organized portfolio of content mapped to the search journey helps establish your brand as an authority.

Couple that with a strong backlink profile, and you’re armed to be a major player in your market.

By analyzing topic clusters, overarching themes naturally emerge, which can be effectively tracked using Profound.

This tool provides a broader context of conversations around each subject.

With a set of topics, Profound’s team creates a bespoke instance for you to track AI search channel performance across:

- ChatGPT-4o Search.

- ChatGPT-4o-mini search.

- Perplexity.

- Microsoft’s Copilot.

If you don’t have your topics clearly developed, you could use any of the following SEO tools to create a list:

- Semrush.

- Ahrefs.

- Keyword Insights.

- thruuu.

- Moz.

This methodology is the future of tracking brand performance in AI search.

Let’s look into a recent experiment we conducted to identify the publications and brands that are visible for a set of Black Friday-related topics.

Get the newsletter search marketers rely on.

The AI search tracking experiment

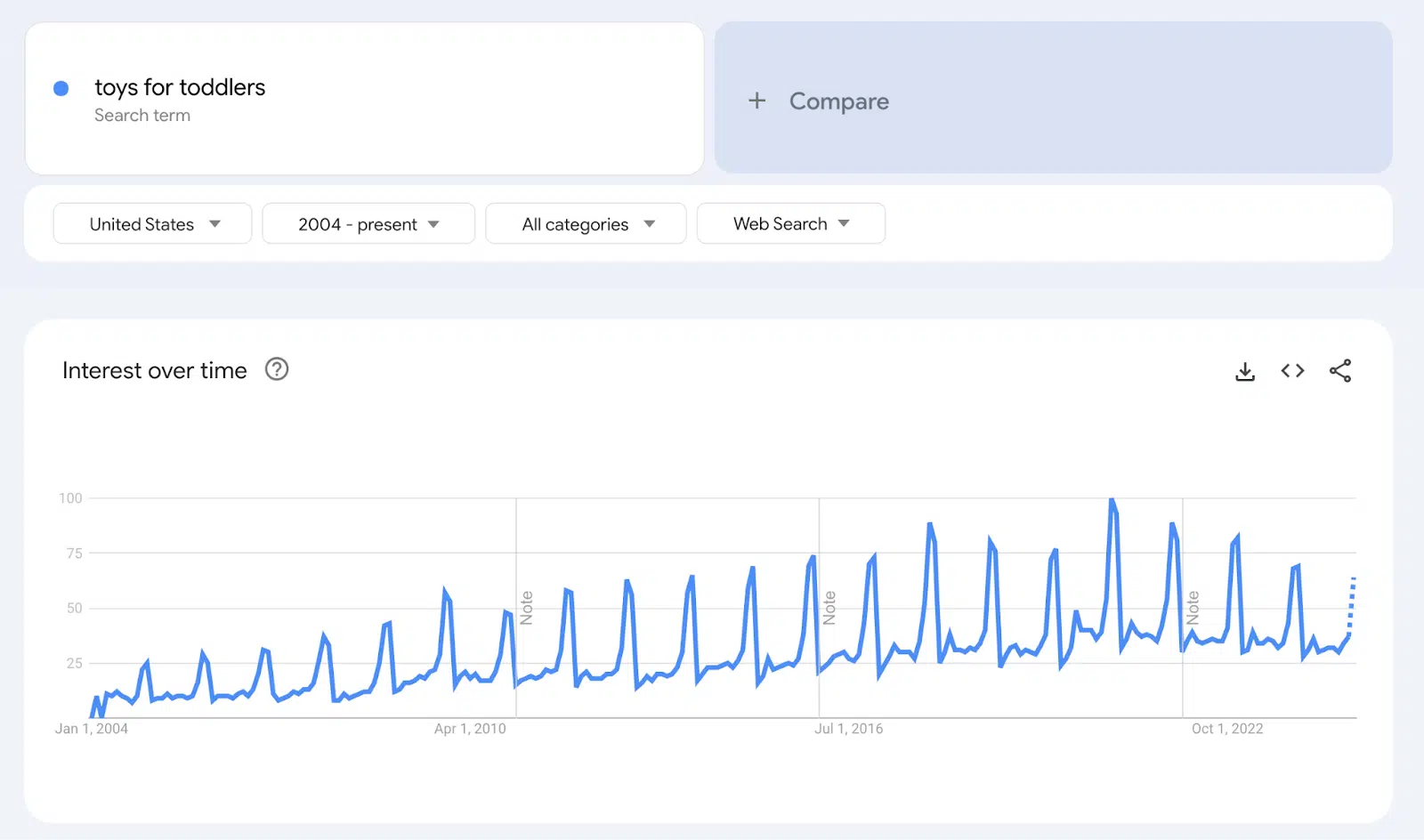

As the father of a toddler girl, I was curious about the competitive toy space as we approached holiday shopping.

You can see the seasonal trends for toy searches as Black Friday rolls around every year.

What better time to investigate the volatility and fluctuations of AI search citations?

I decided to investigate how toy brands like Fisher-Price and Melissa & Doug fare across AI search channels.

In my experiment, instead of relying on typical SEO tools, I took a different topical research approach.

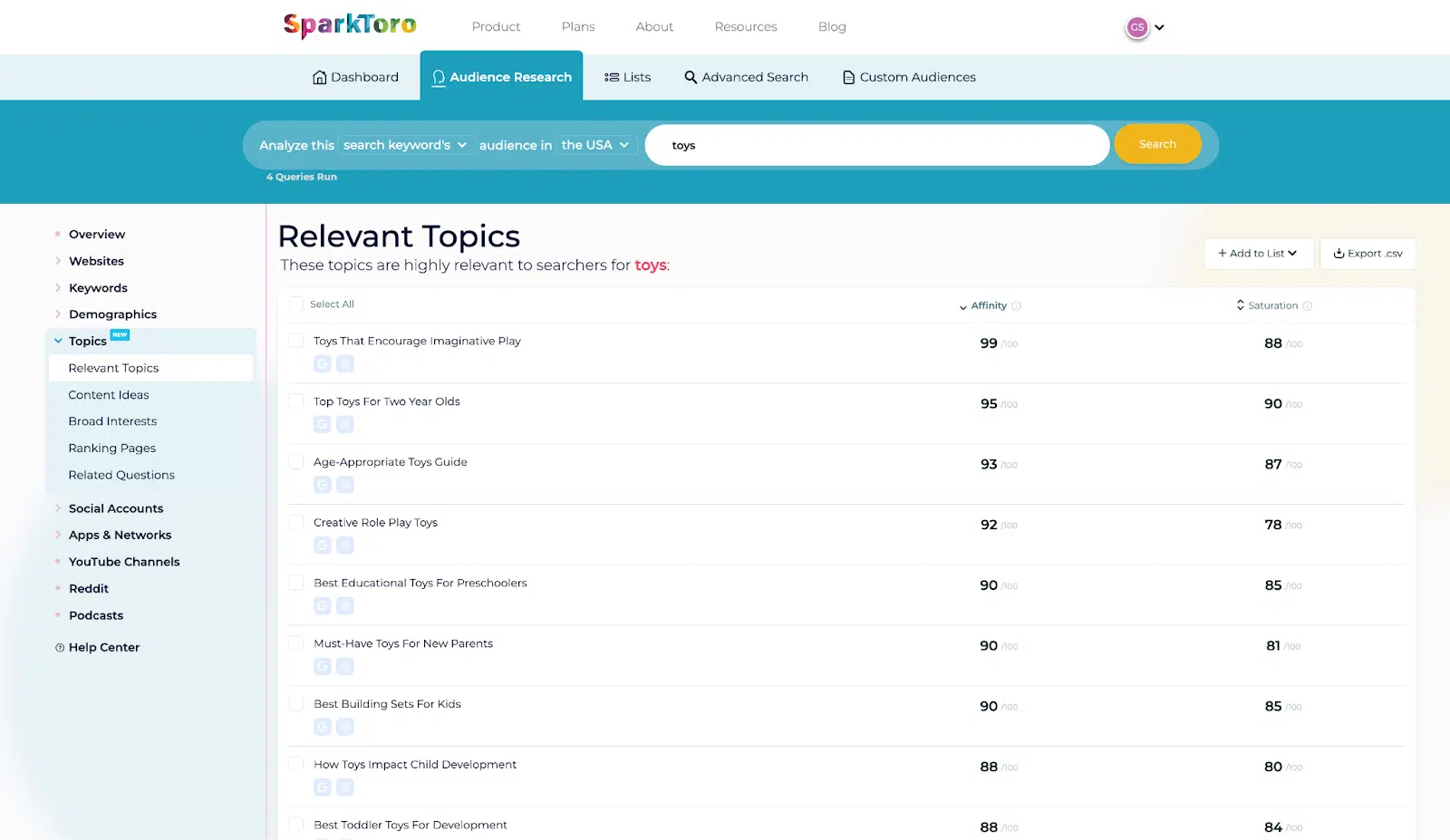

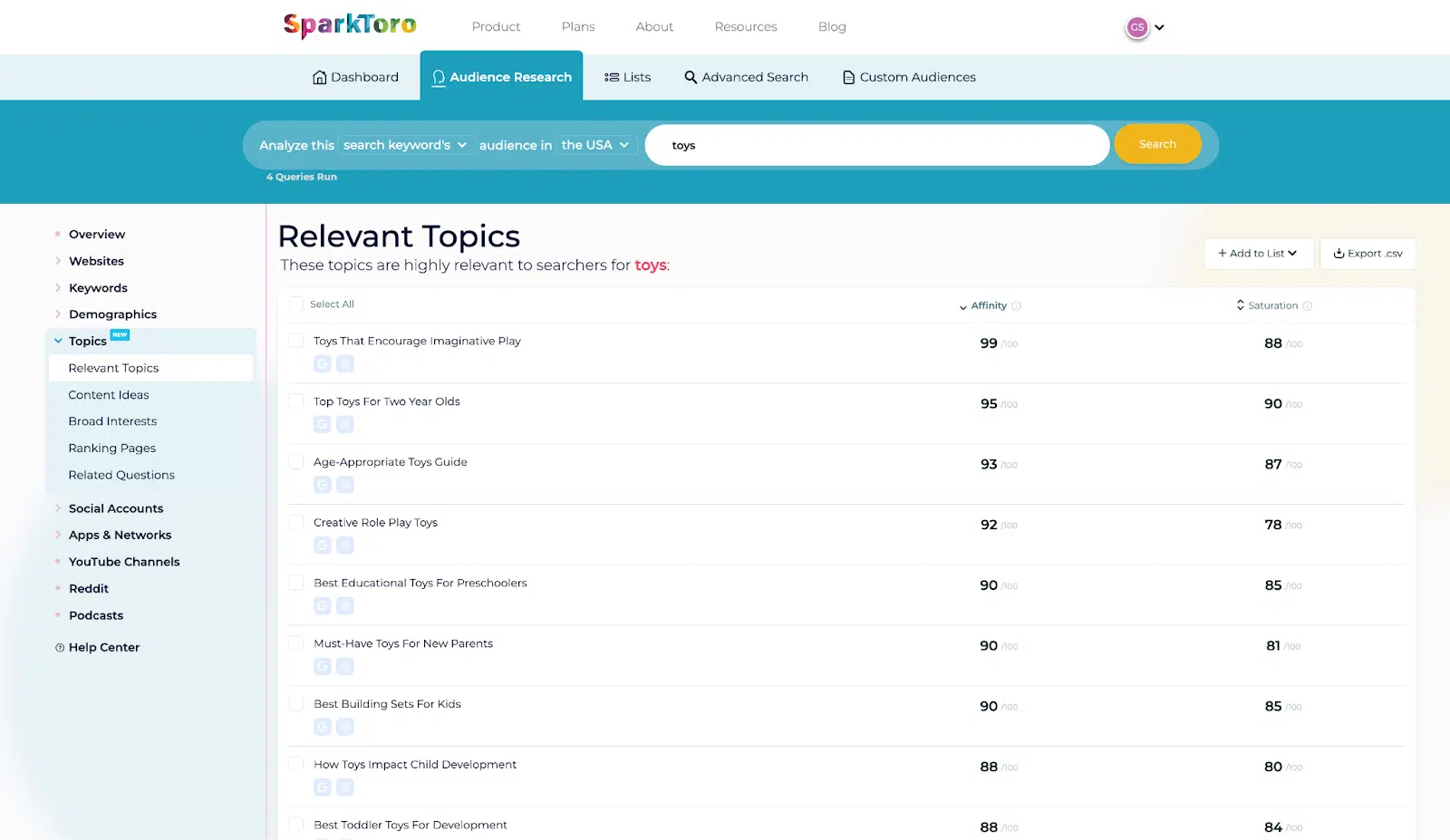

I used SparkToro’s recent Relevant Topics feature to identify what’s important in the toy industry, tapping into what parents like myself are searching for this season.

This feature takes a keyword and identifies a list of bespoke topics that appear across all of the websites, social profiles and forums your target audience engages with based on a specific location.

I generated the SparkToro relevant topic list to use with Profound before the holiday shopping season.

Using the keyword “toys,” I created a list of 50 toy-related topics.

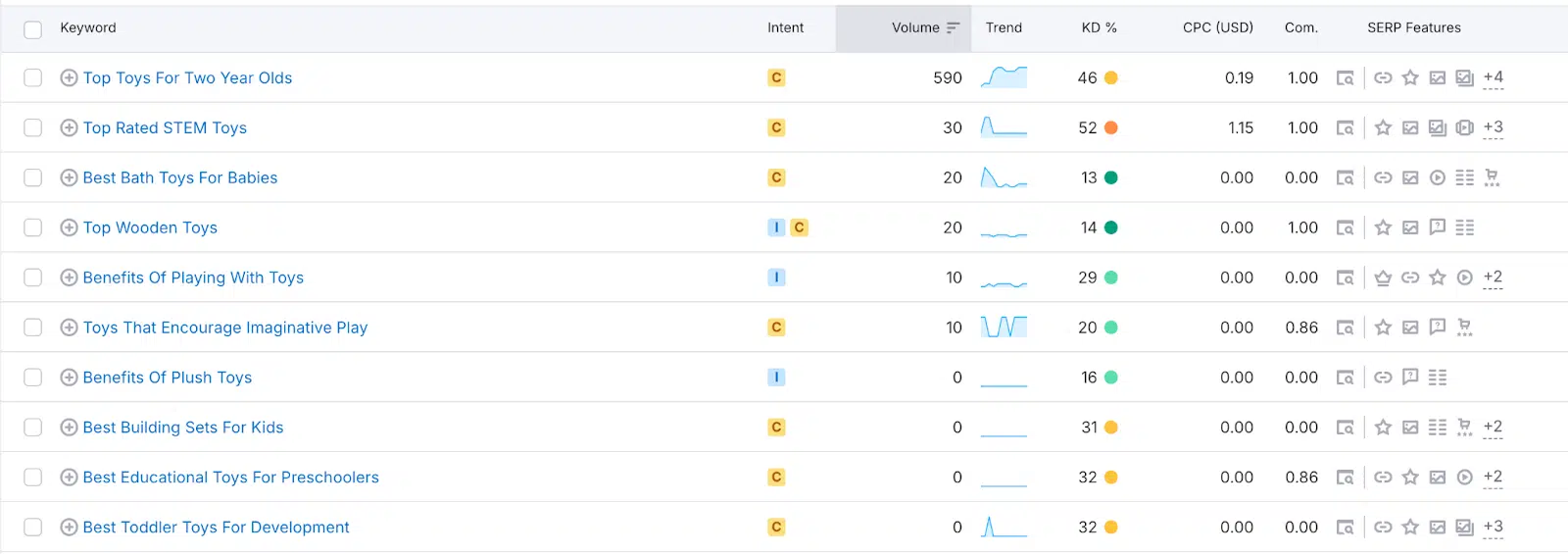

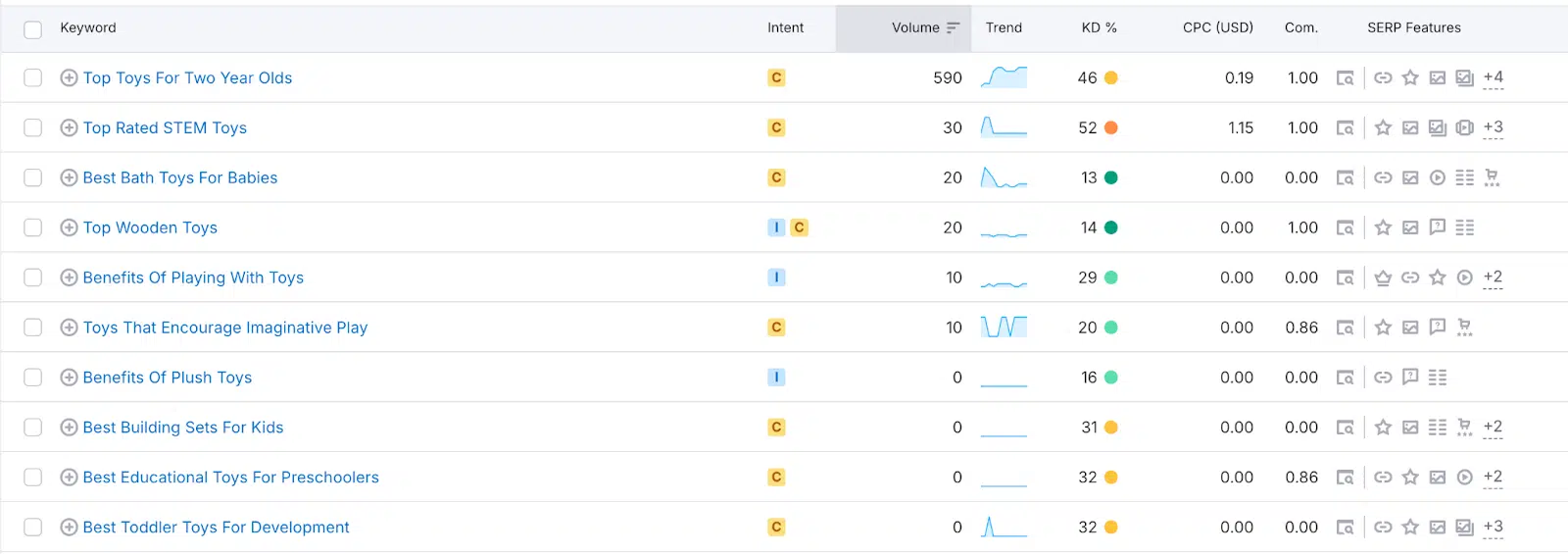

These topics covered everything from wooden toys to outdoor toys. After checking the search volume in Semrush, I discovered that the topics themselves were low volume.

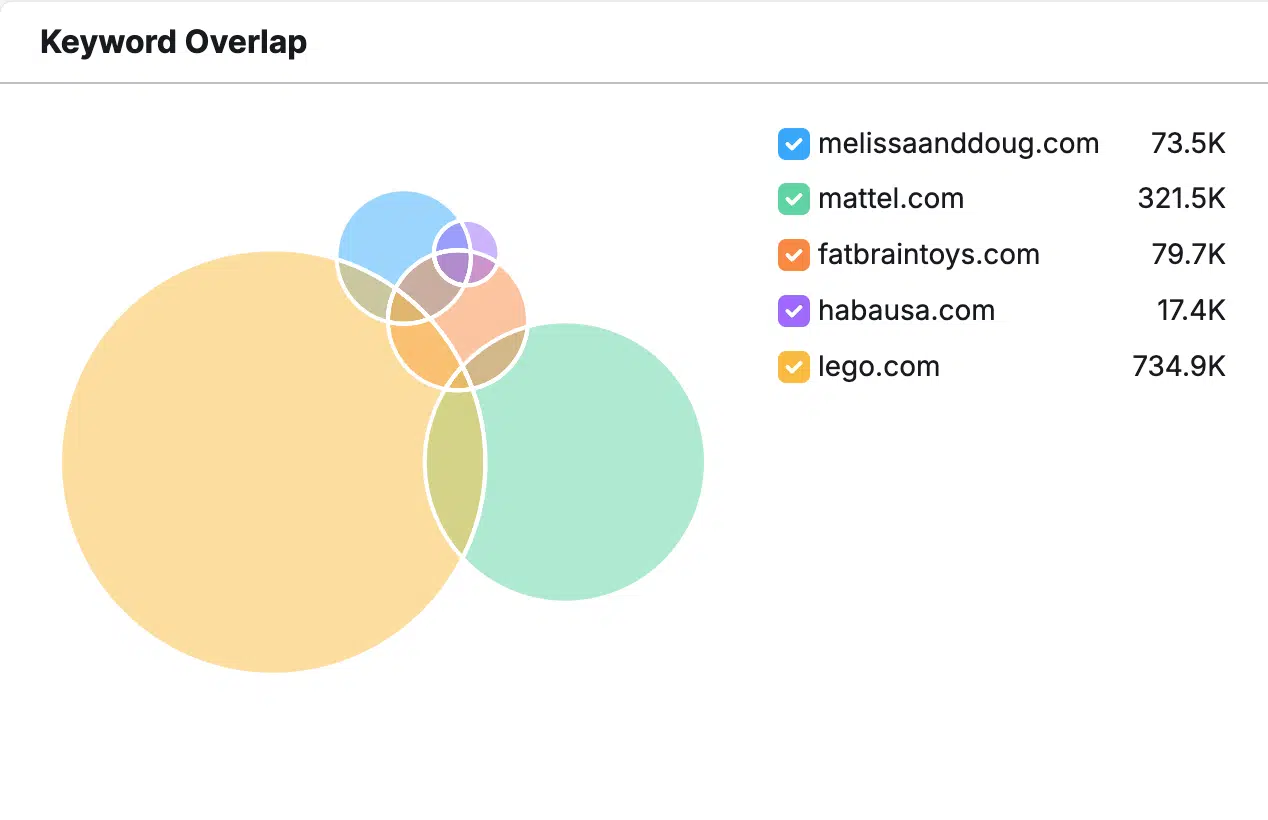

Using Semrush, I identified direct toy manufacturer competitors to Fisher-Price and Melissa and Doug.

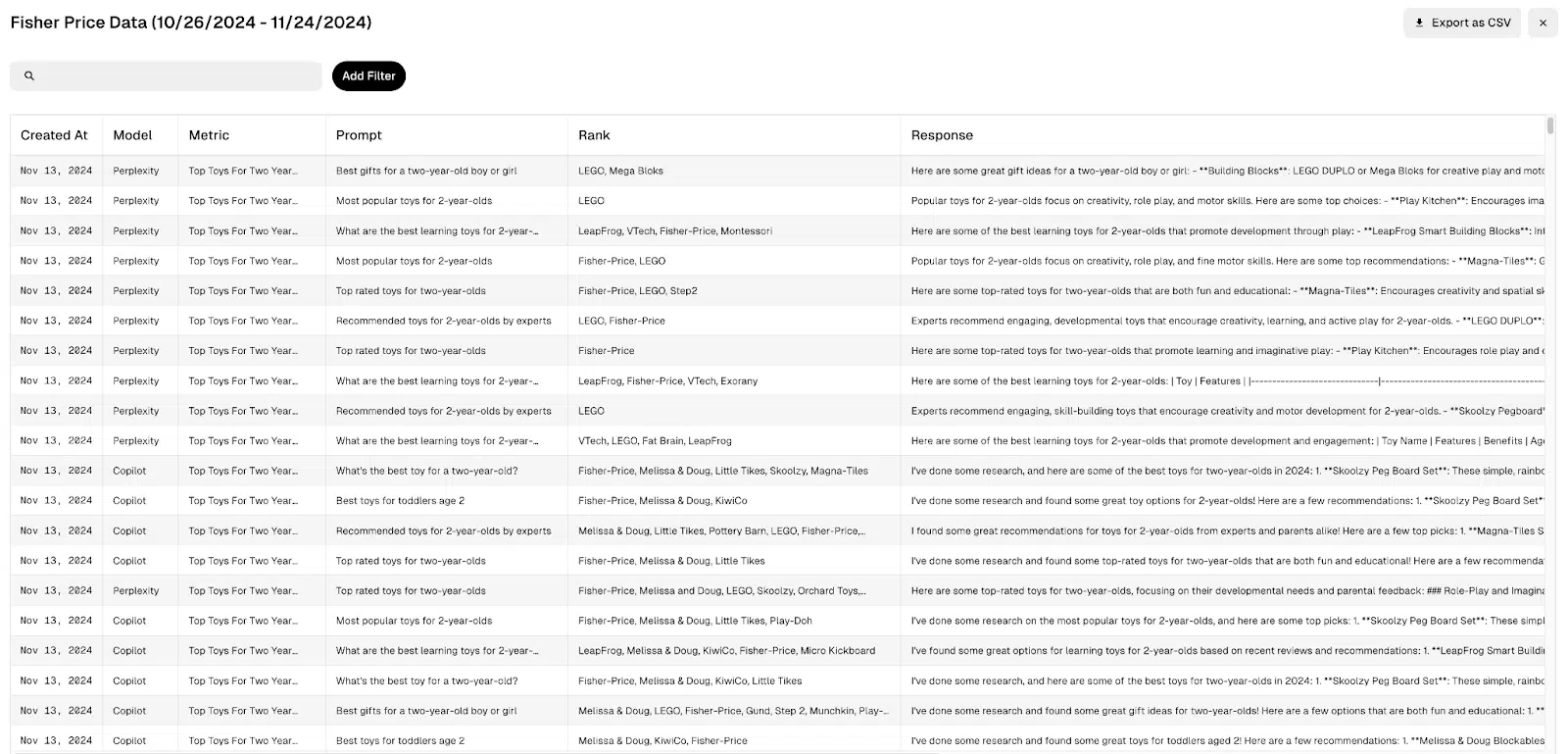

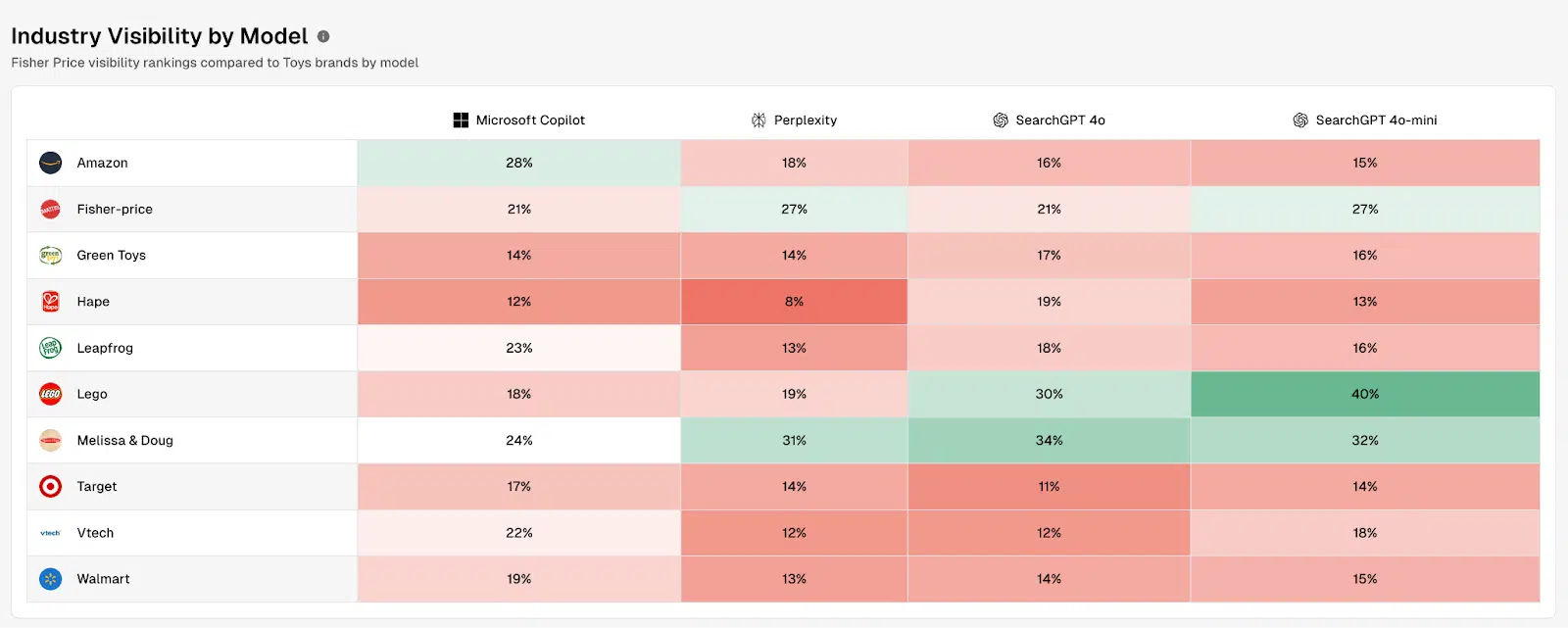

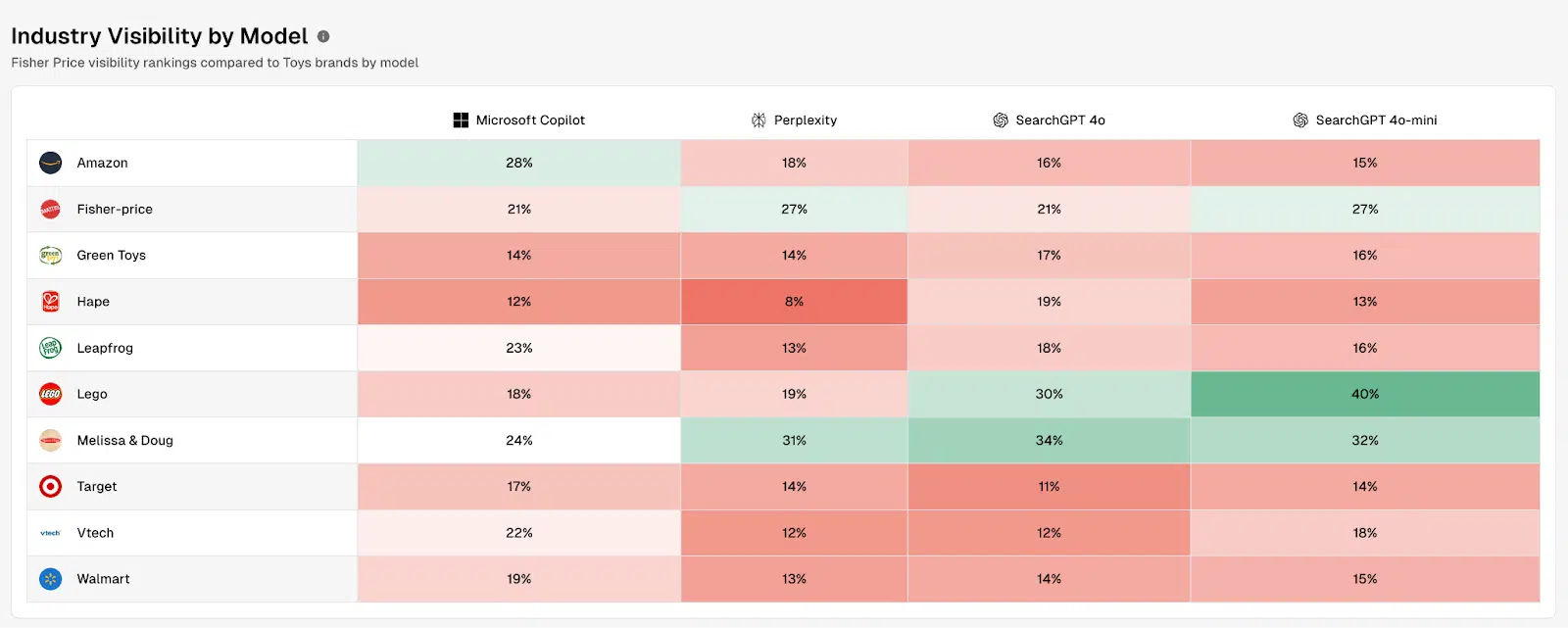

The Profound team took our list of topics and competitors and began tracking performance across ChatGPT, Perplexity and Copilot.

Each day, Profound generated various prompts for each topic that would likely generate brand mentions. It would capture the responses, brand rankings and citations for analysis.

Over a week, trends started to emerge.

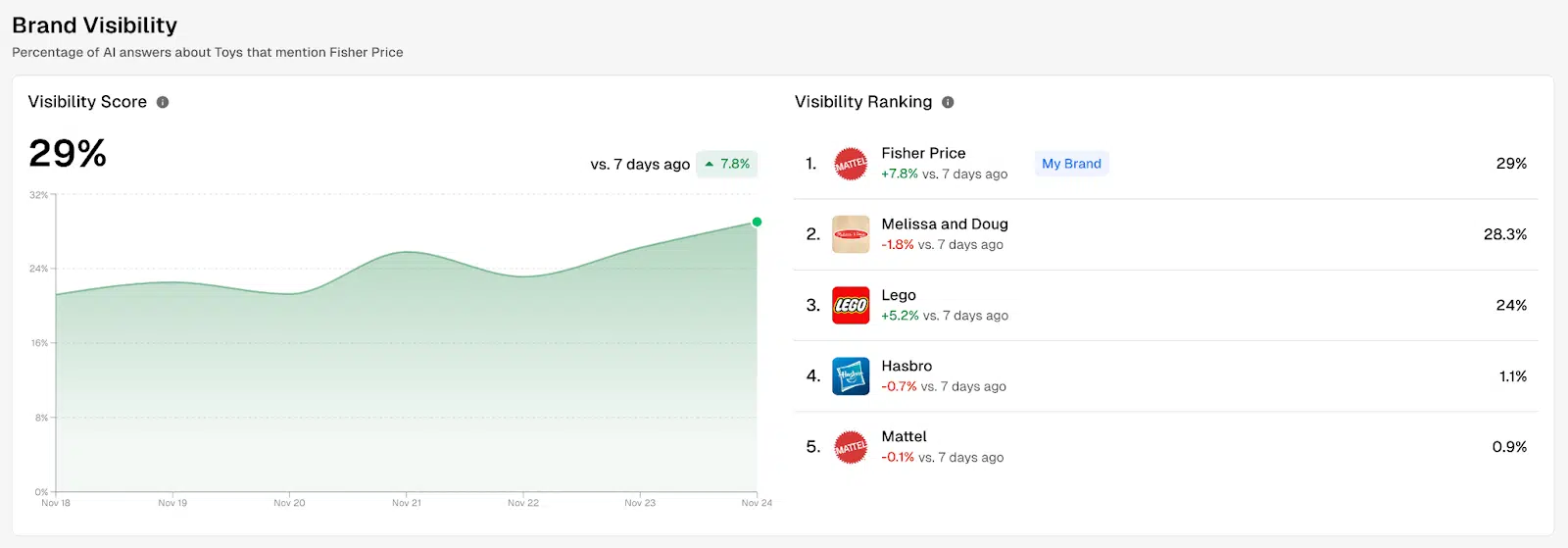

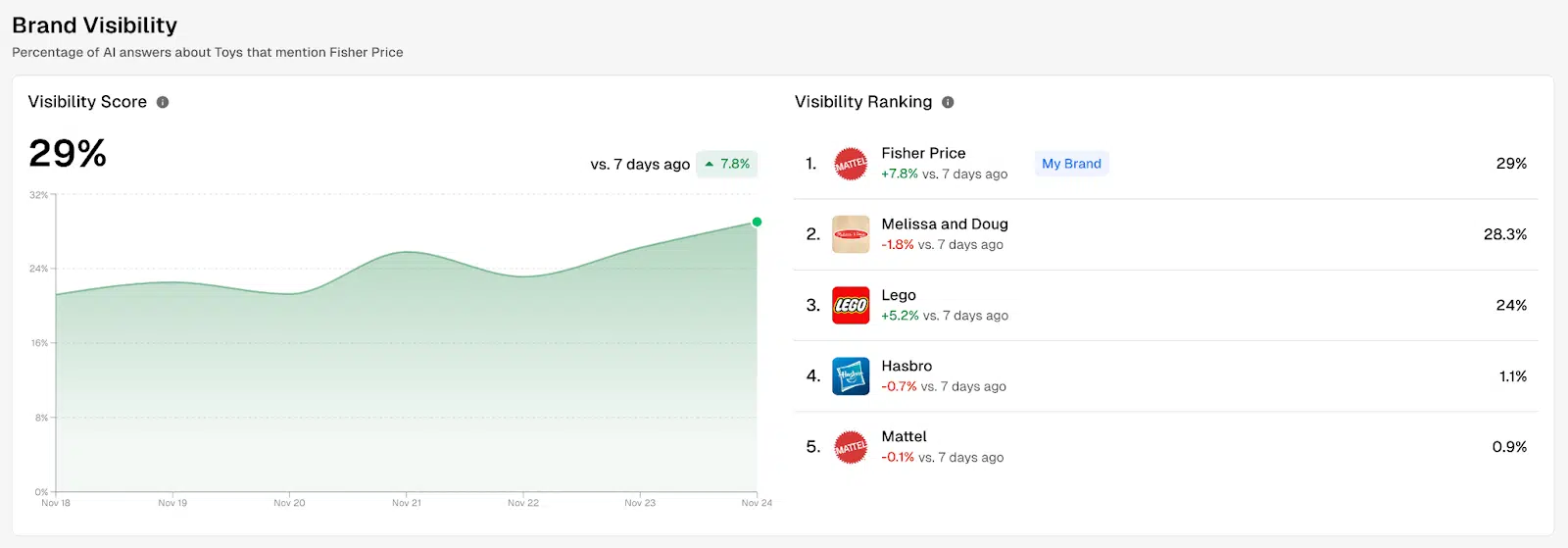

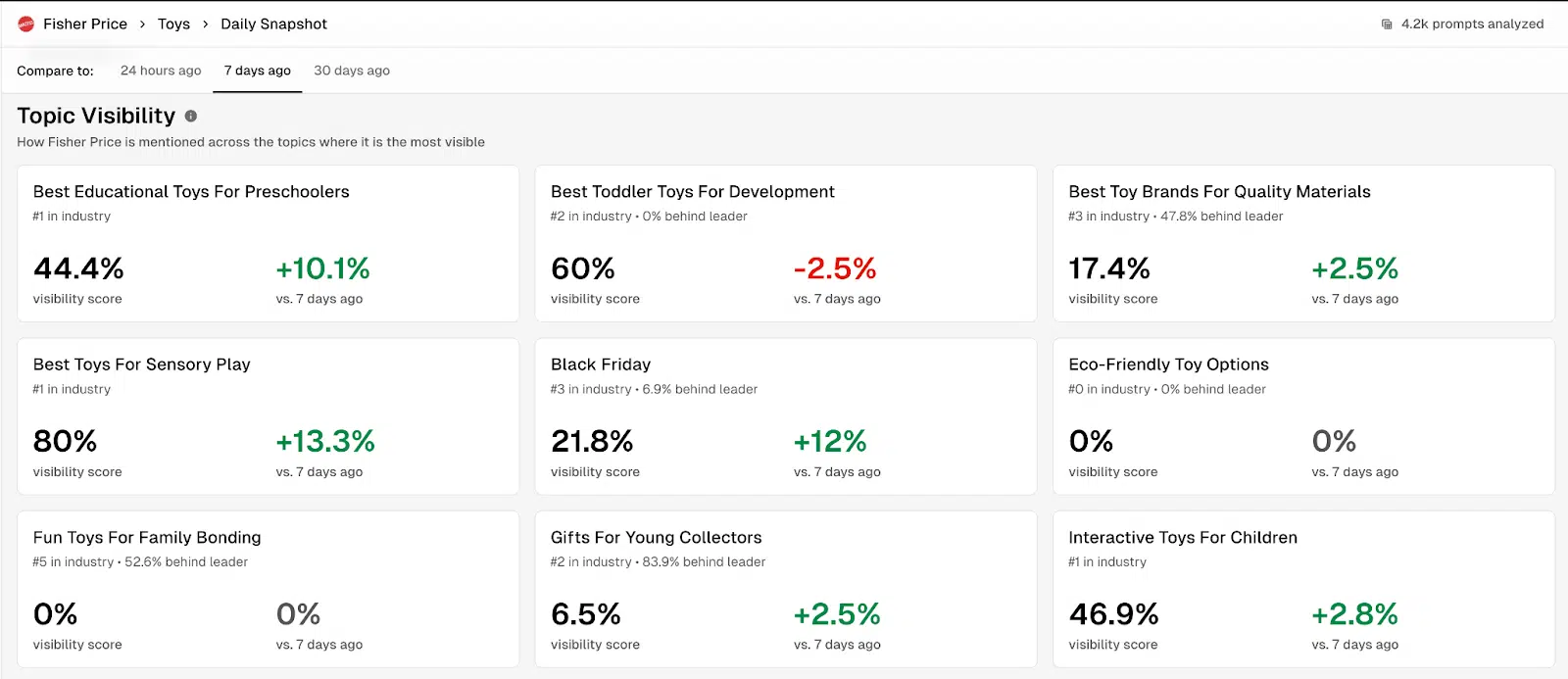

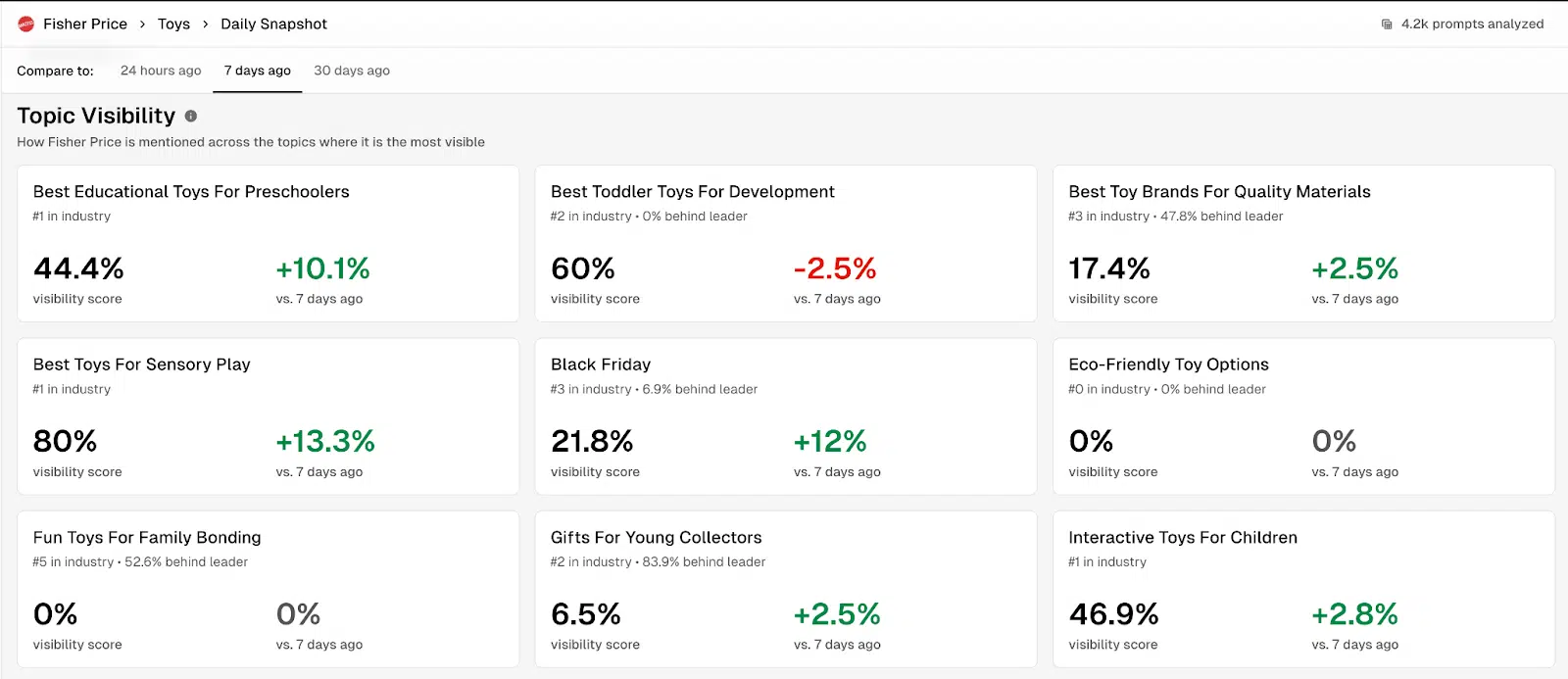

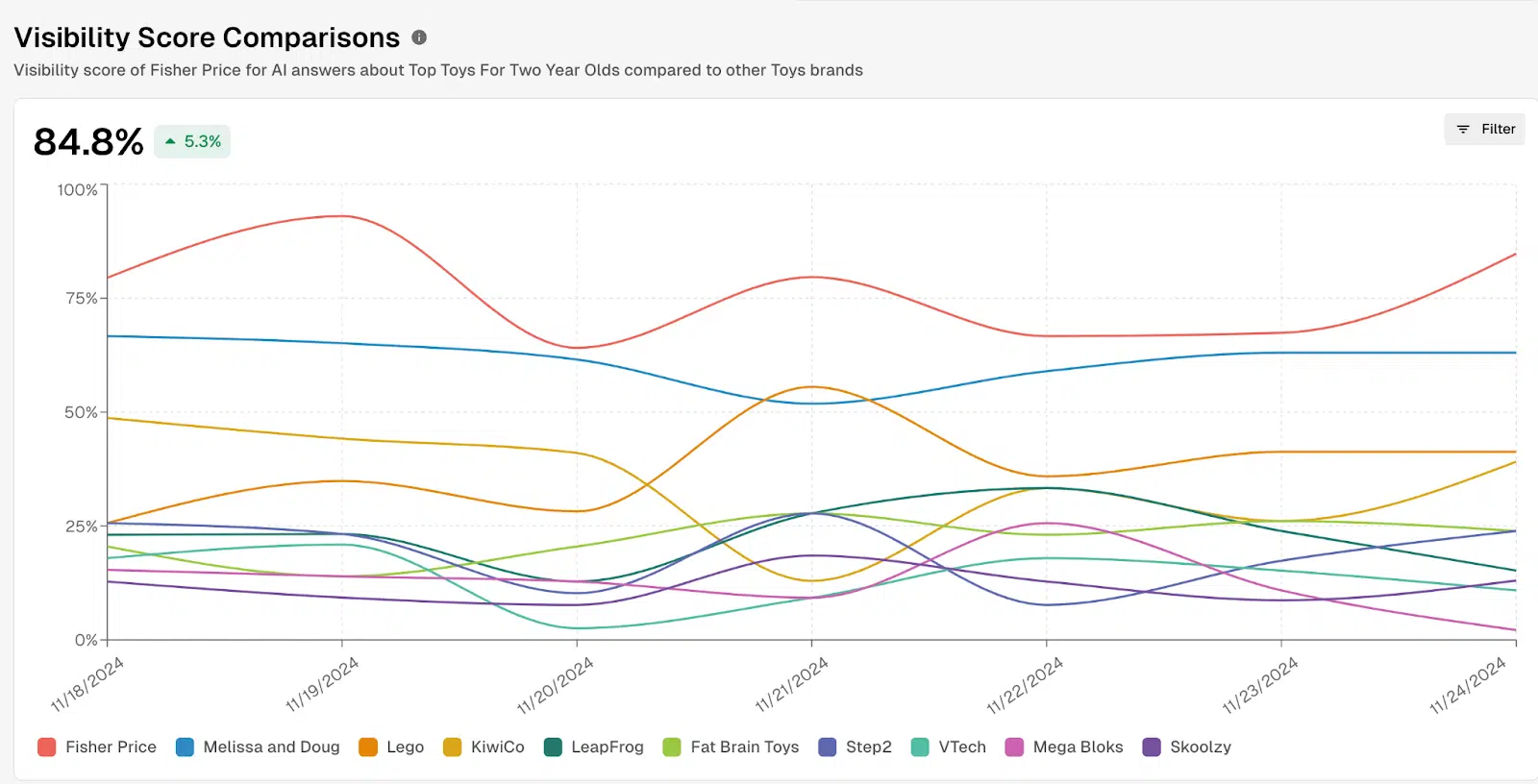

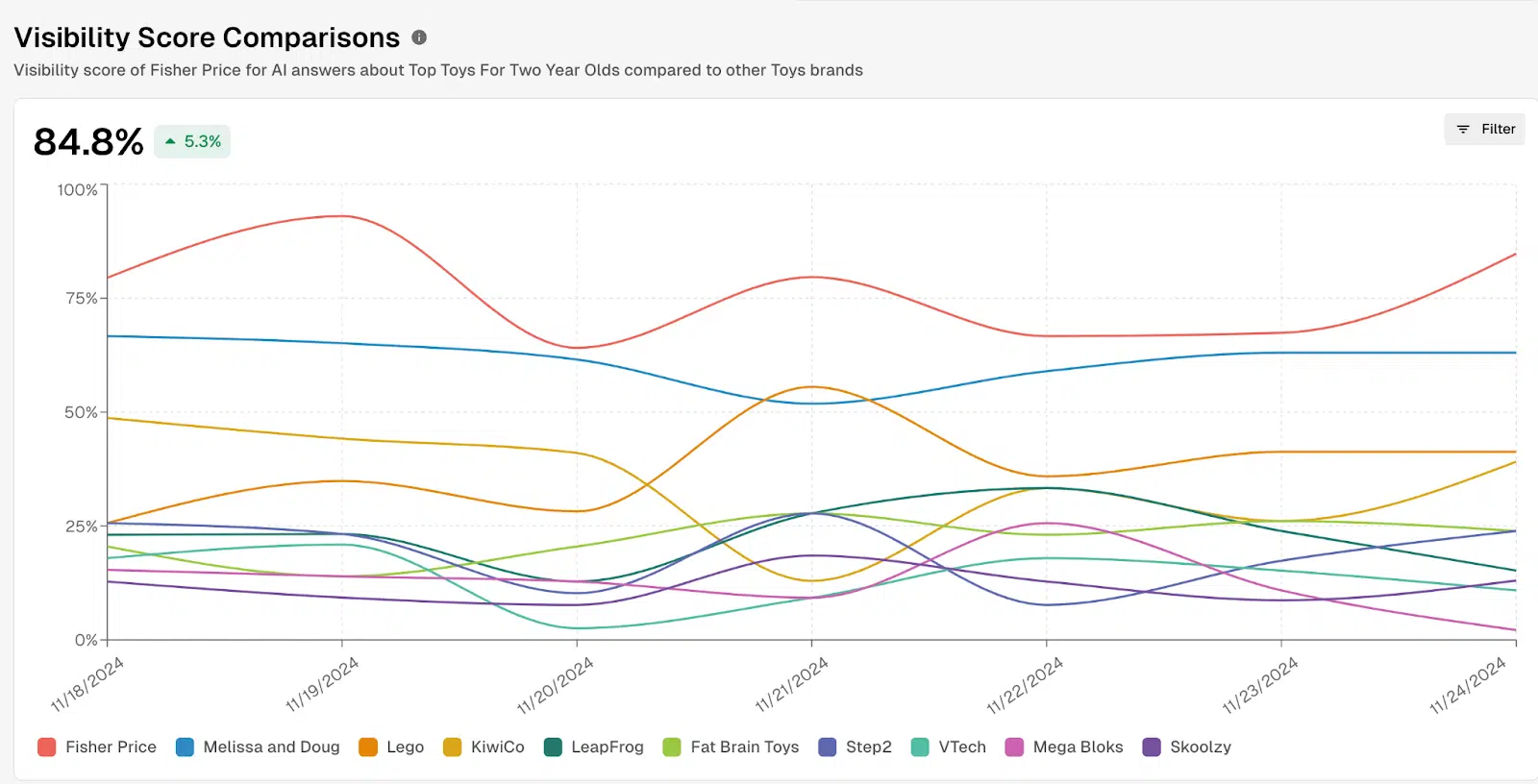

We can see improvement in visibility compared to the previous seven-day total for the topics that were important to my Fisher-Price products.

Brand visibility calculates the percentage of AI answers across all topics that mention your brand.

We can get visibility into the brand’s performance per AI search model.

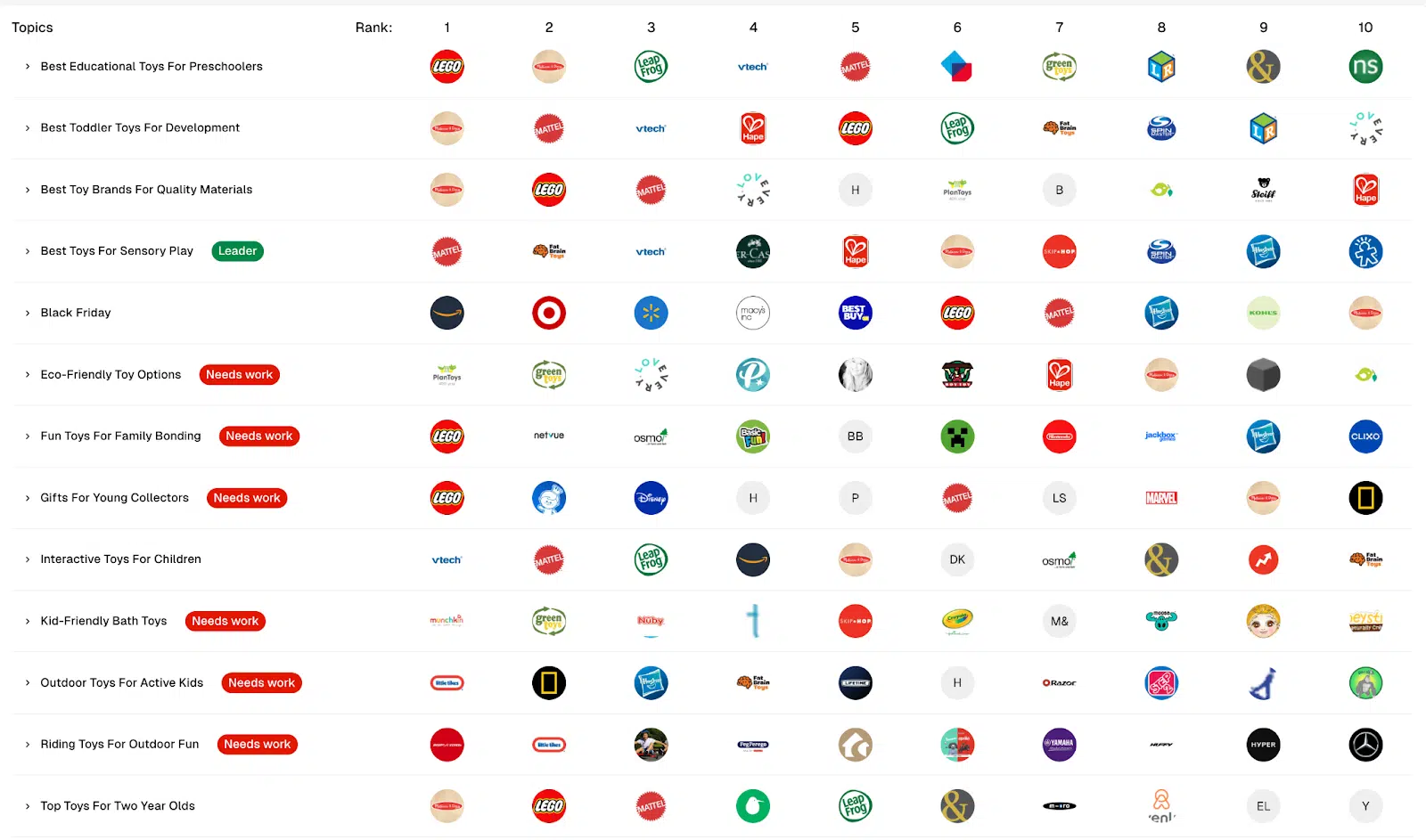

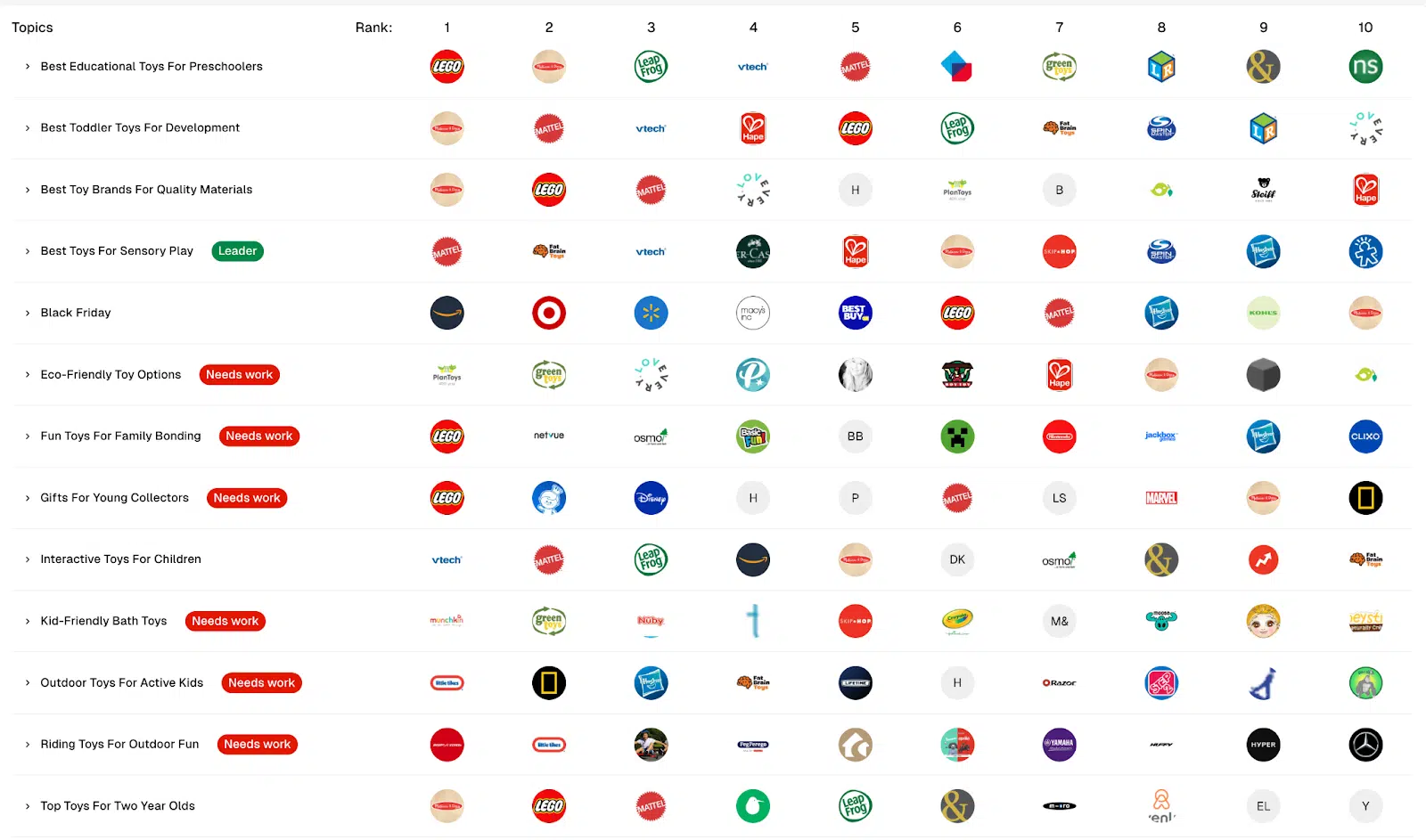

Drilling into topic visibility, we can see Fisher-Price is the market leader across six of the nine topics.

You can see how easy it is to get clarity from the topics important to your business goals.

You can visualize the rank competition for each topic as well:

Now, imagine that you want to focus on a specific topic and get even more granular.

This is where you can start thinking about content strategy for improving your brand visibility for a specific topic important to your business.

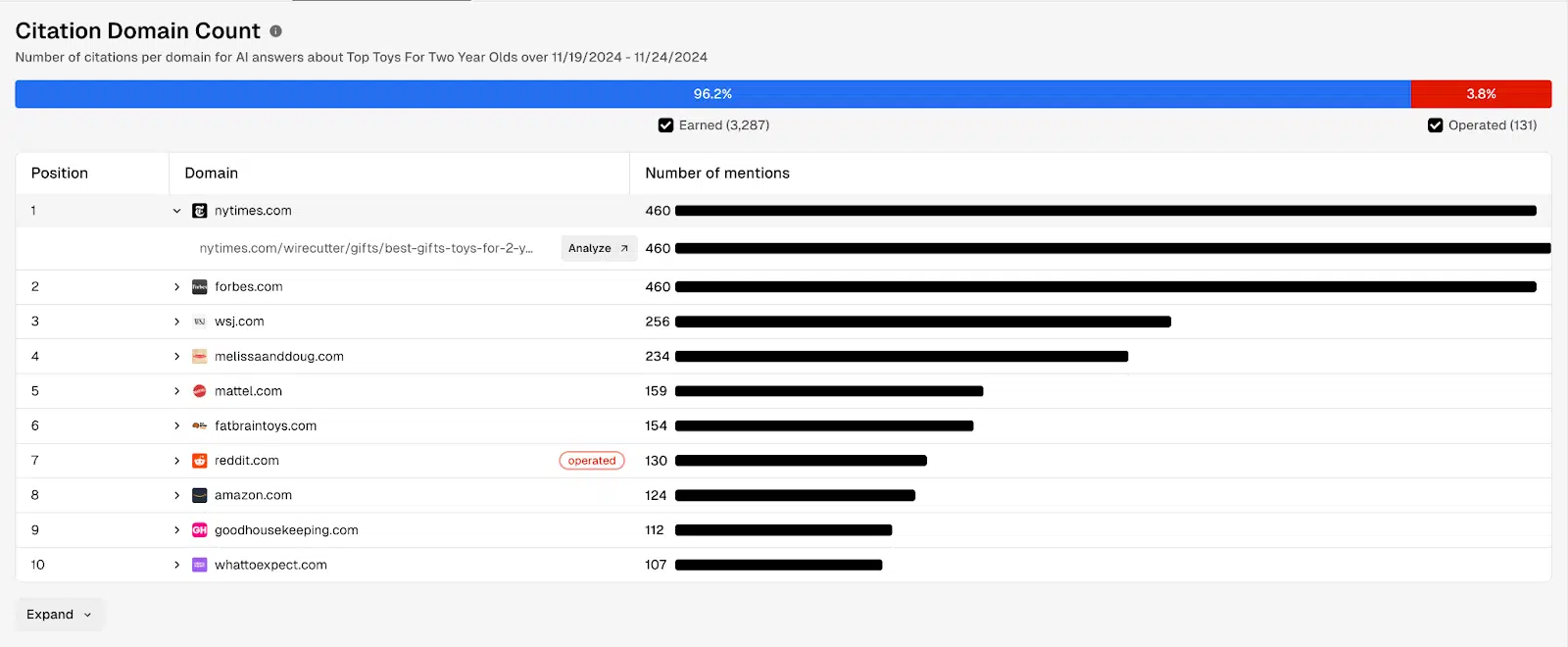

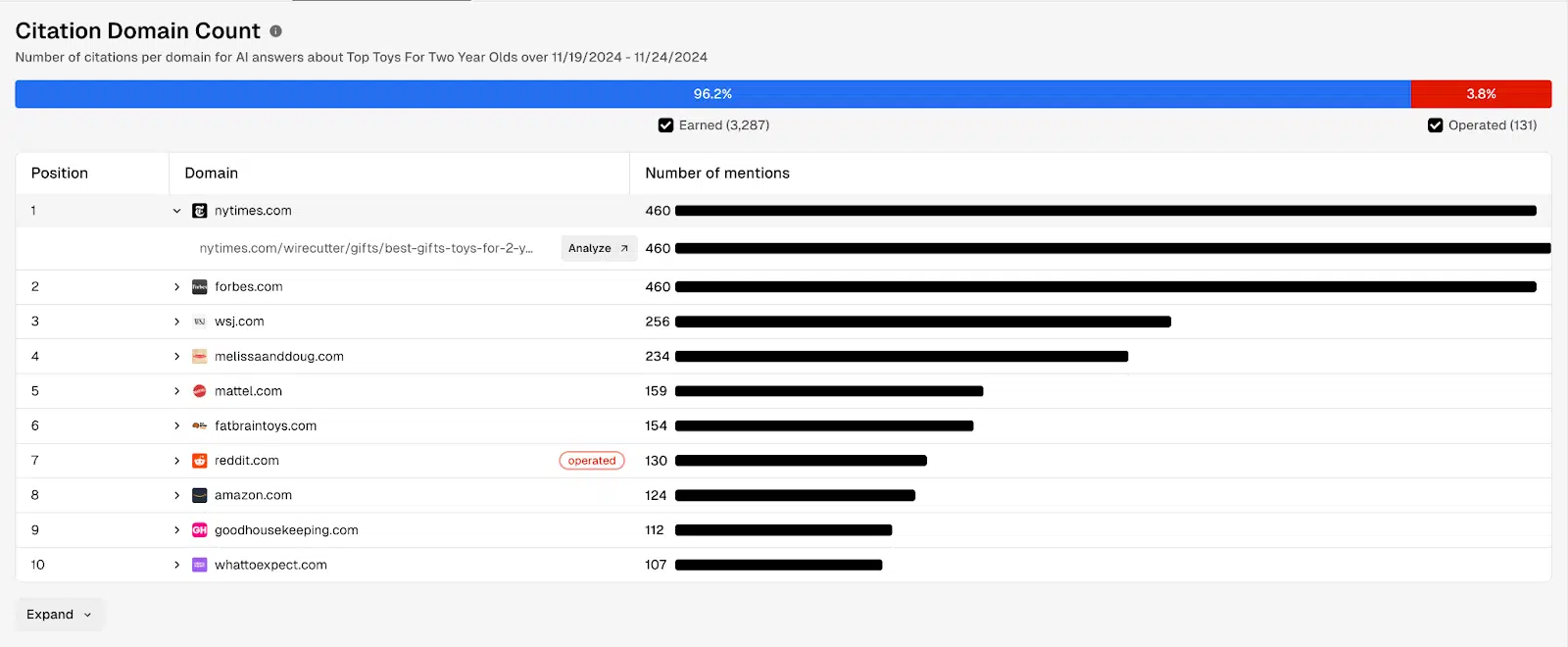

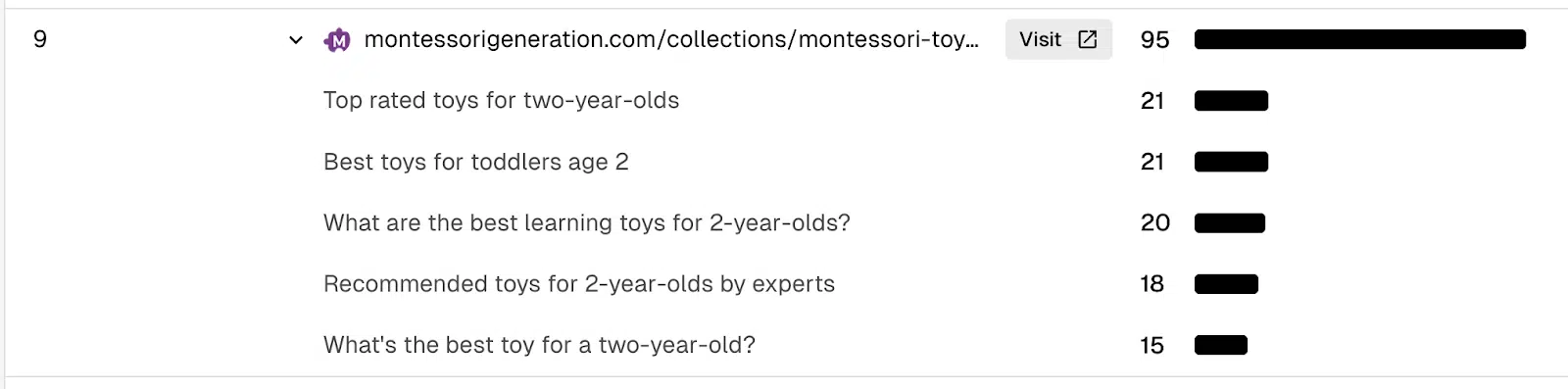

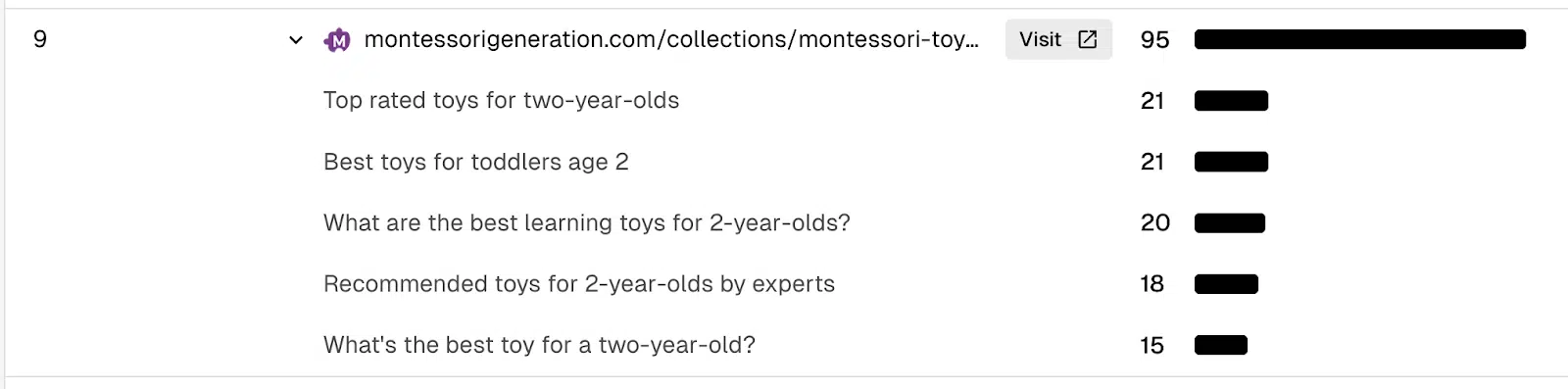

Let’s look at the topic: “Top Toys for Two-Year-Olds.”

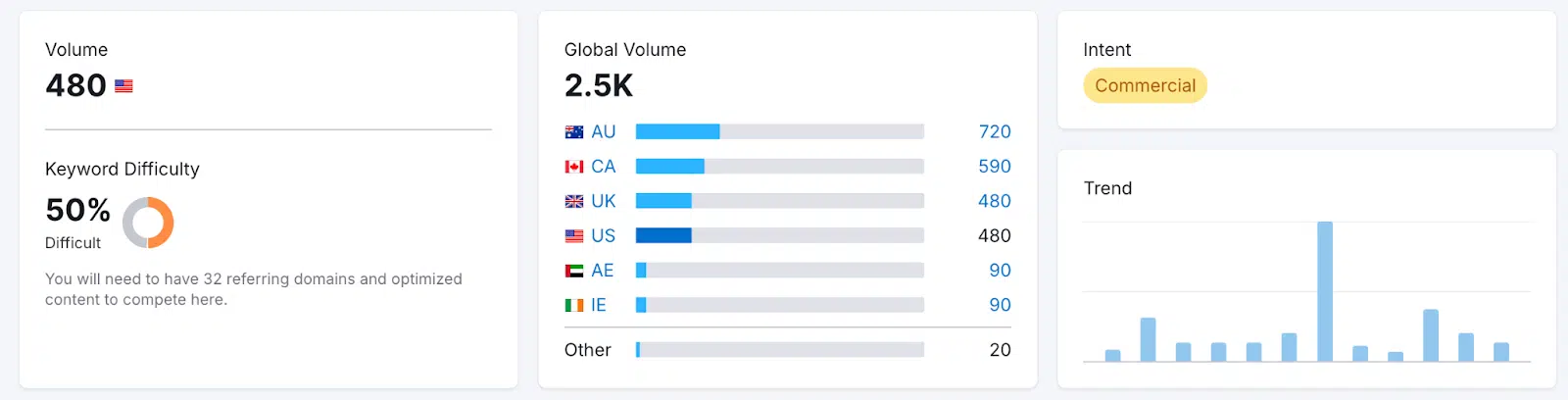

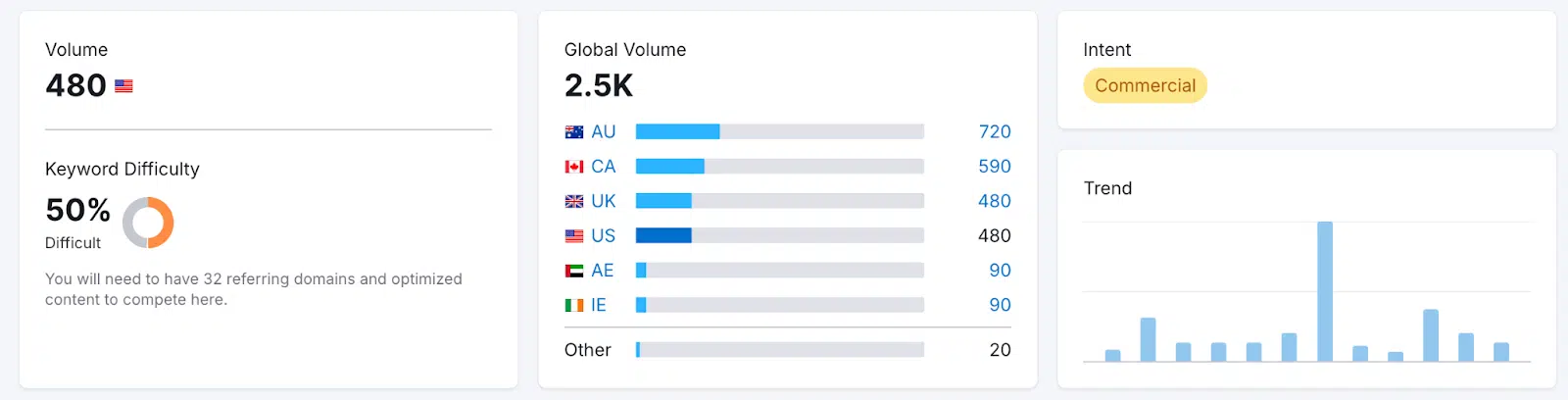

In Semrush, this commercial keyword alone has a search volume of 480 per month in the U.S.

While that’s not a massive number of searches, expanding it to a full topic would likely incorporate hundreds of additional searches.

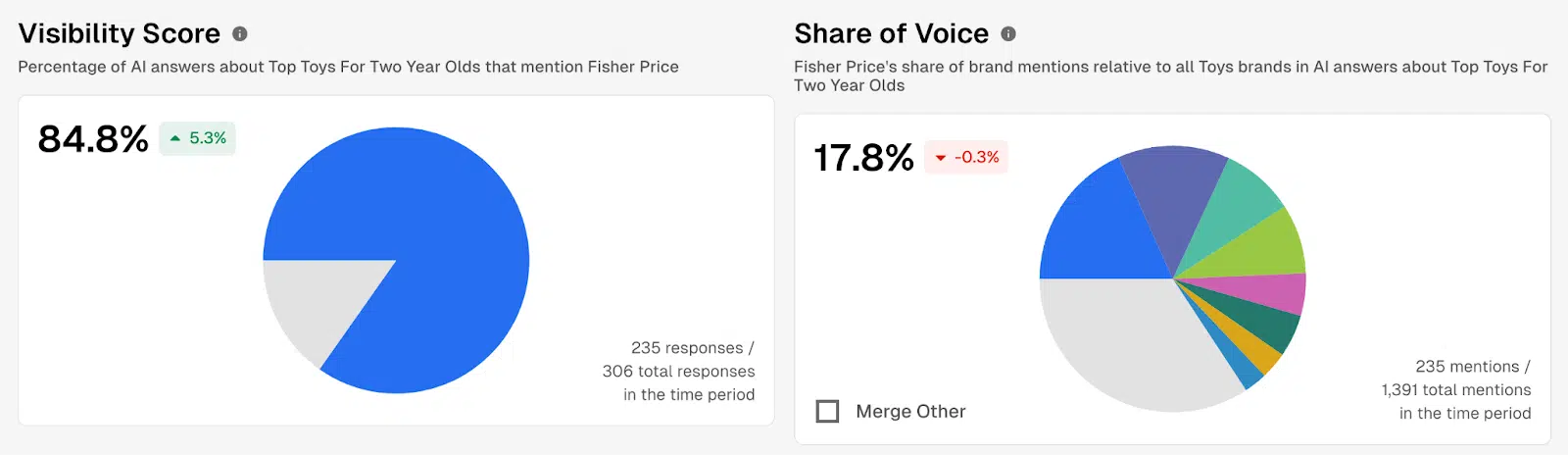

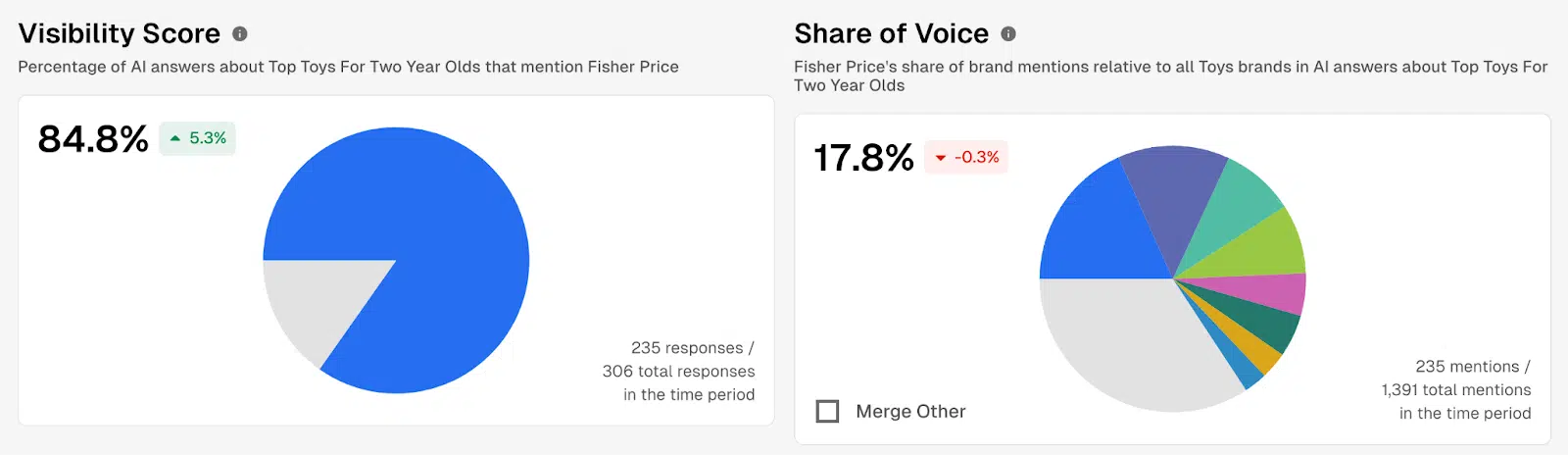

Fisher-Price is already performing well on this topic, with a visibility score of 84%.

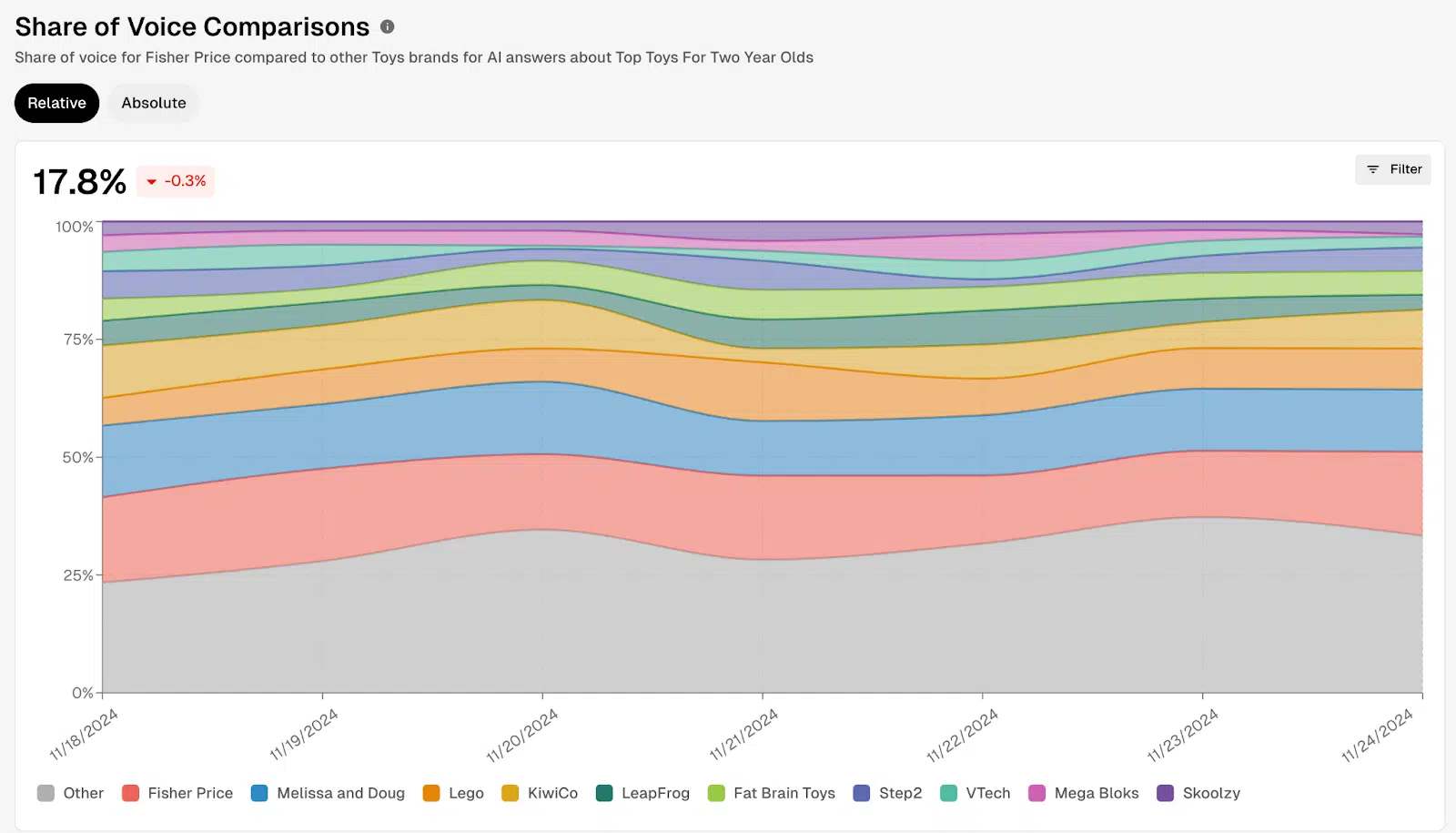

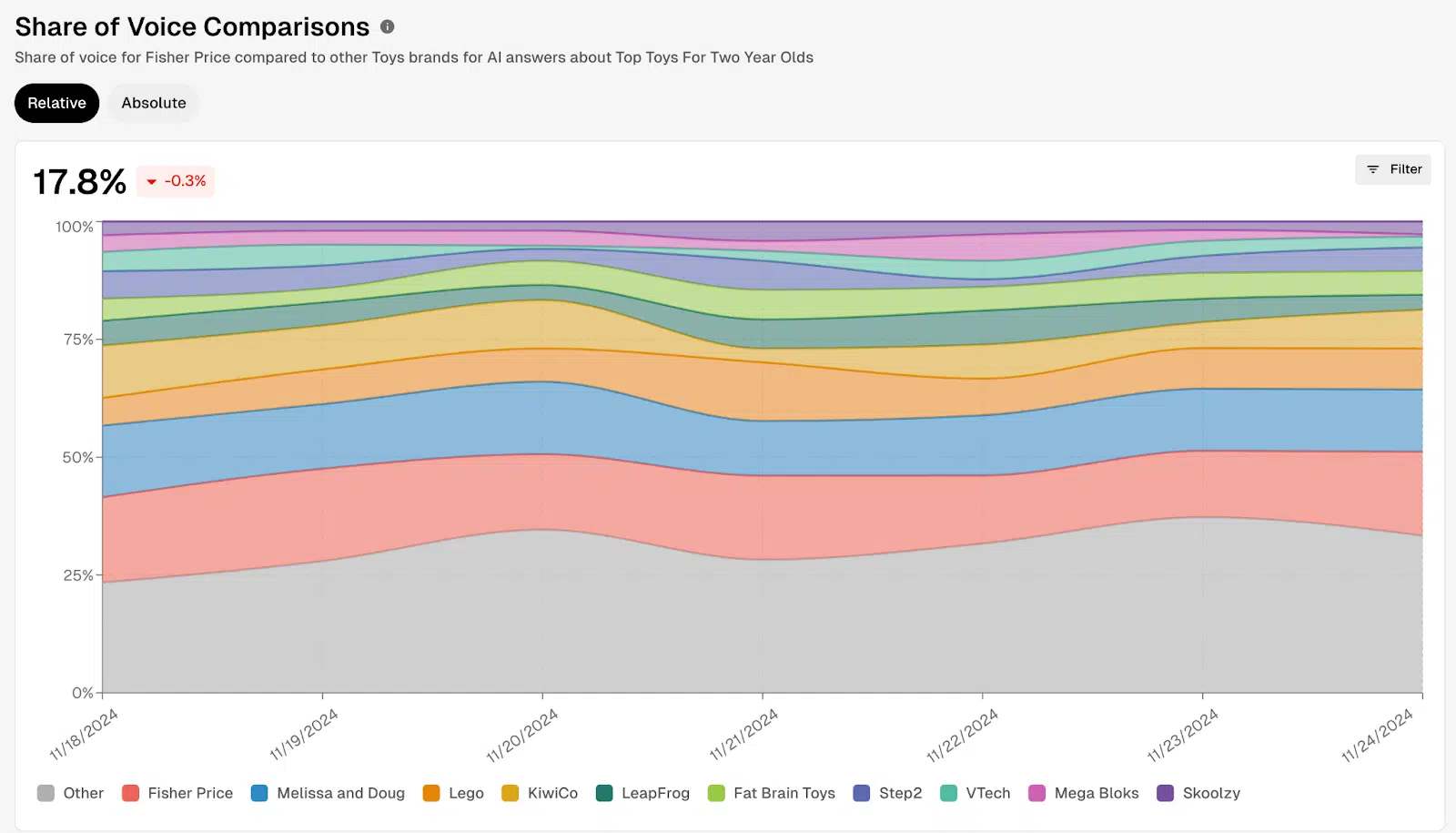

Taking “Top Toys for Two-Year-Olds,” we can look at the visibility and share of voice over time.

These visualizations can provide useful insights for companies that want to track how their various AI search-driven content and digital PR experiments are performing.

Keep in mind that:

Let’s double-check our work by plugging this topic into our AI search tools:

ChatGPT

Perplexity

Copilot

Each of these searches produces citations that include Fisher-Price toys on their lists.

Notice that all of the citations are from publications and not the manufacturers.

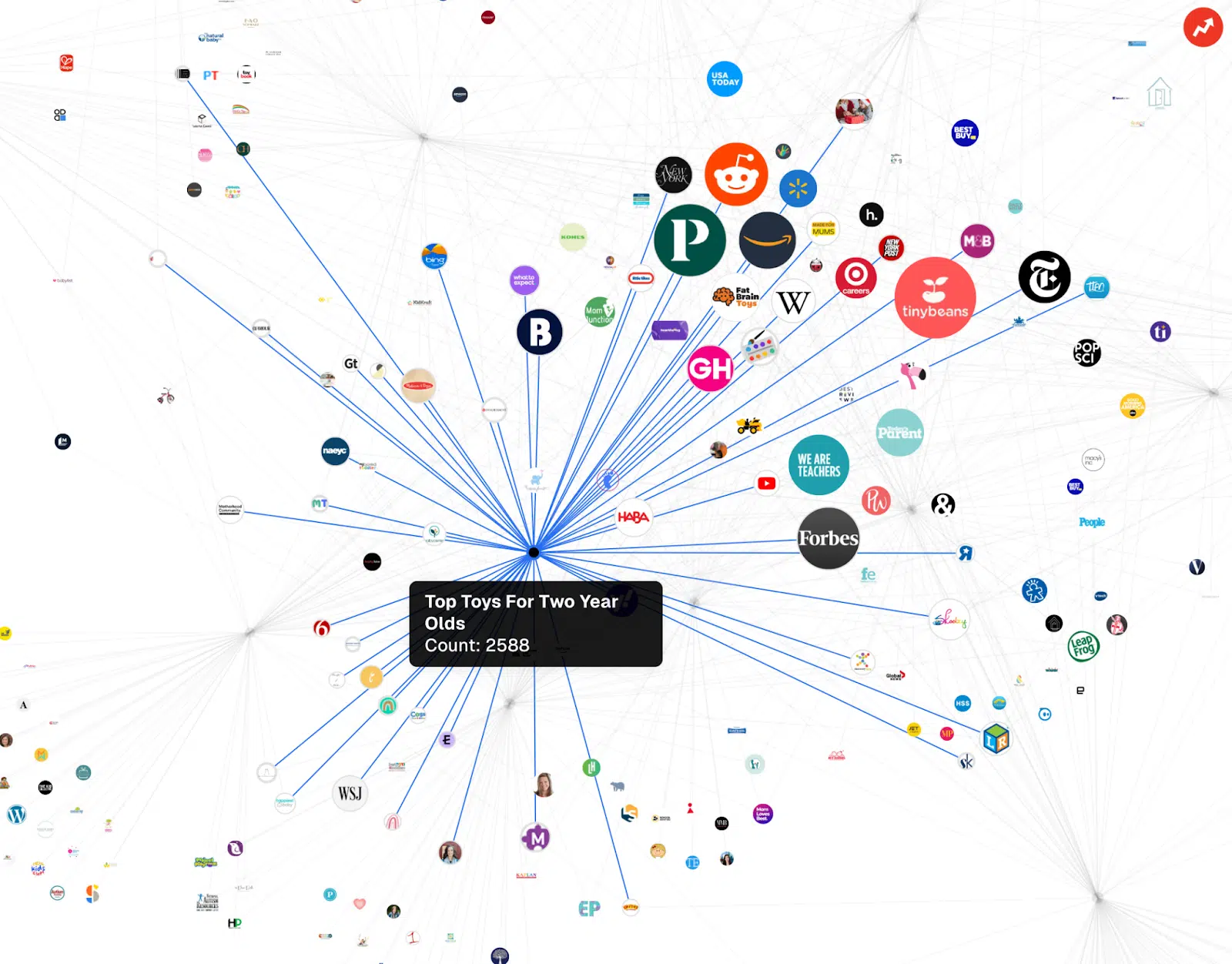

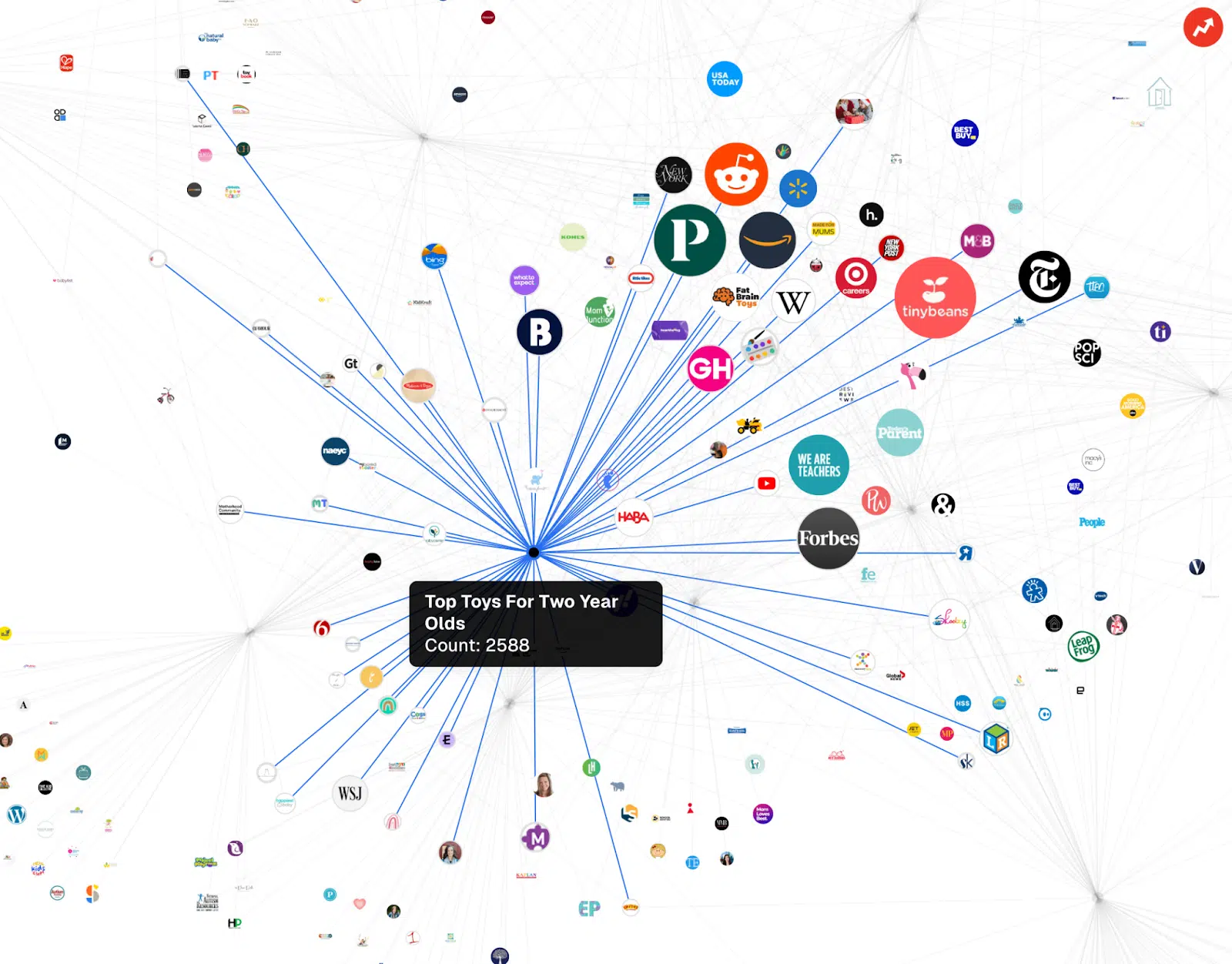

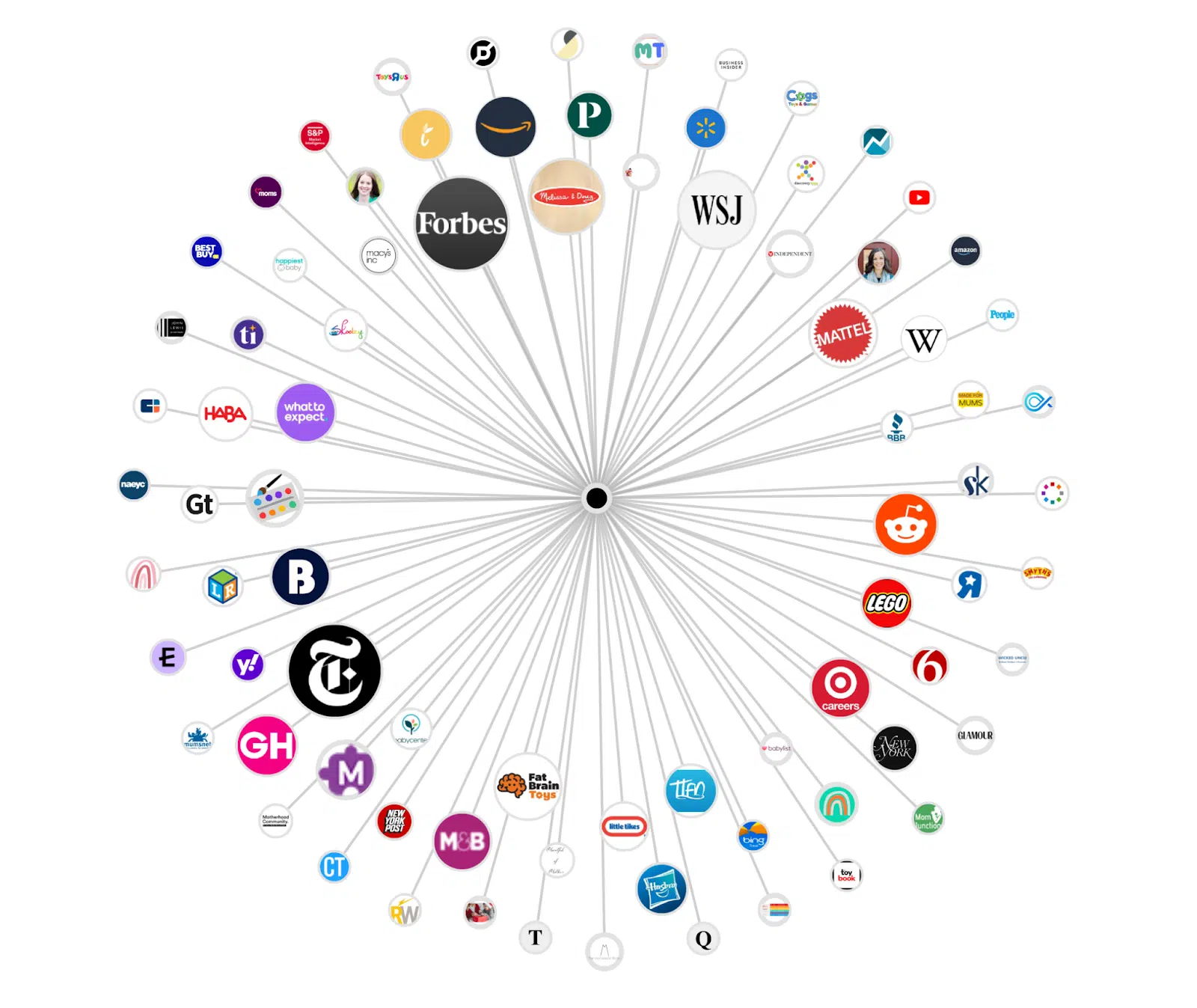

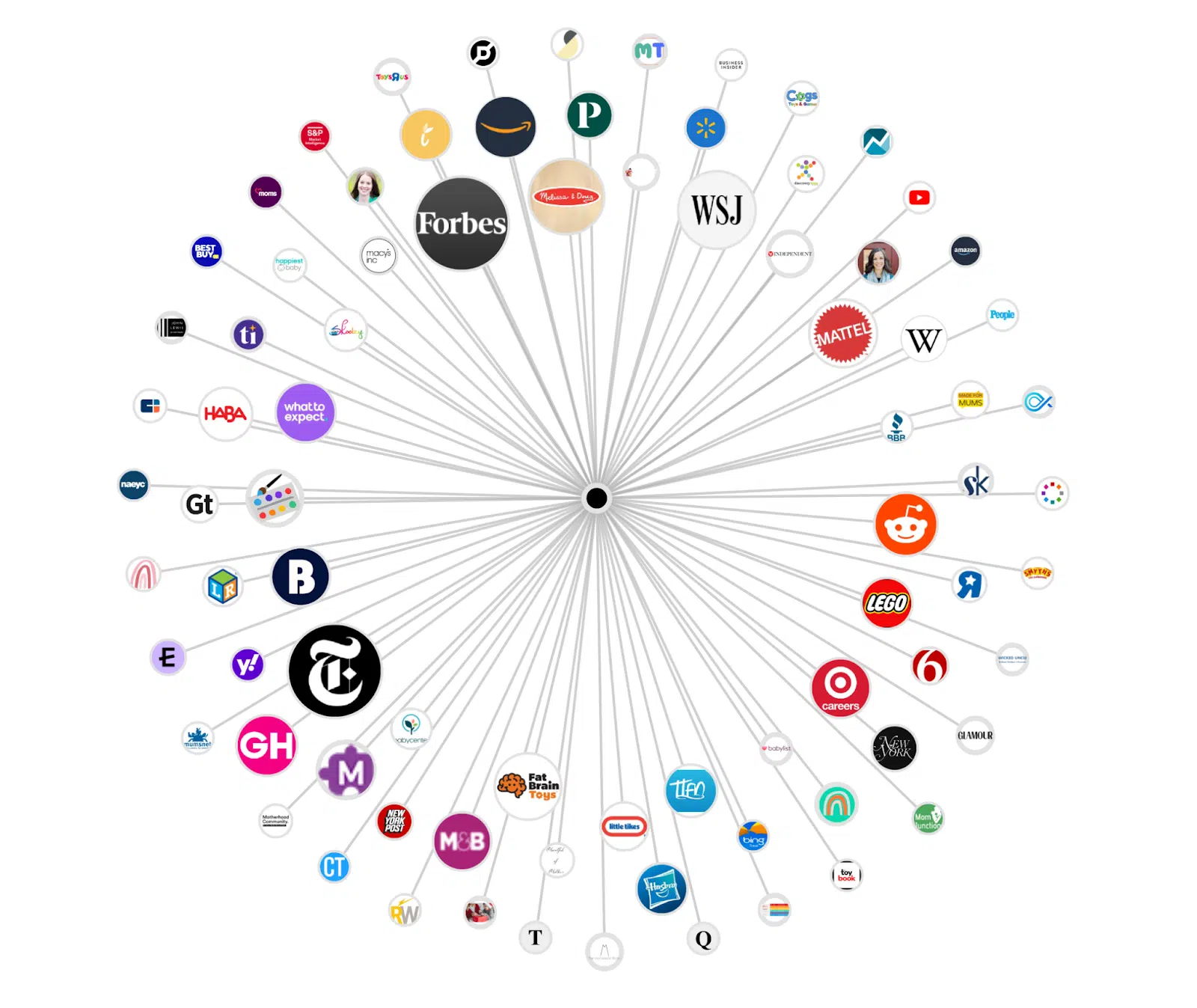

The real magic and tactical importance of this process occurs when you analyze the citations that the conversational searches use and link to:

The data is all included, but Profound offers this near visualization of the citation nodes at a comprehensive and individual topic level.

You can look at the specific URLs cited by volume and filter by search model. You can also see which URLs are cited for multiple search prompts.

Now, you can develop your own digital PR list with specific publications and URLs to target.

Digital PR and content strategy for AI search

AI search tools’ outputs are dynamic.

They always change based on:

- How we phrase our search.

- The personalized output based on an individual’s interactions with the tool.

- The constantly updated content on the web.

It’s a true moving target.

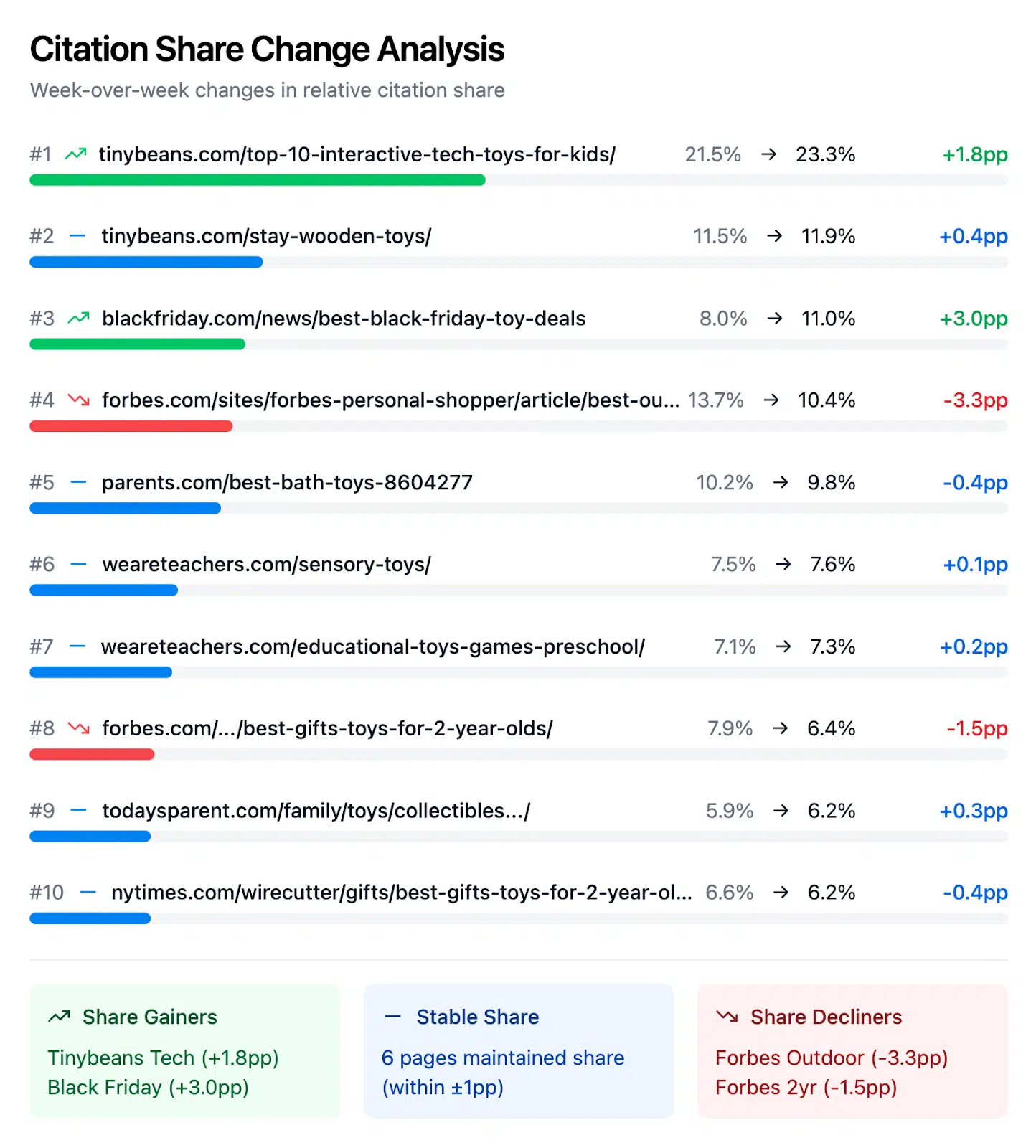

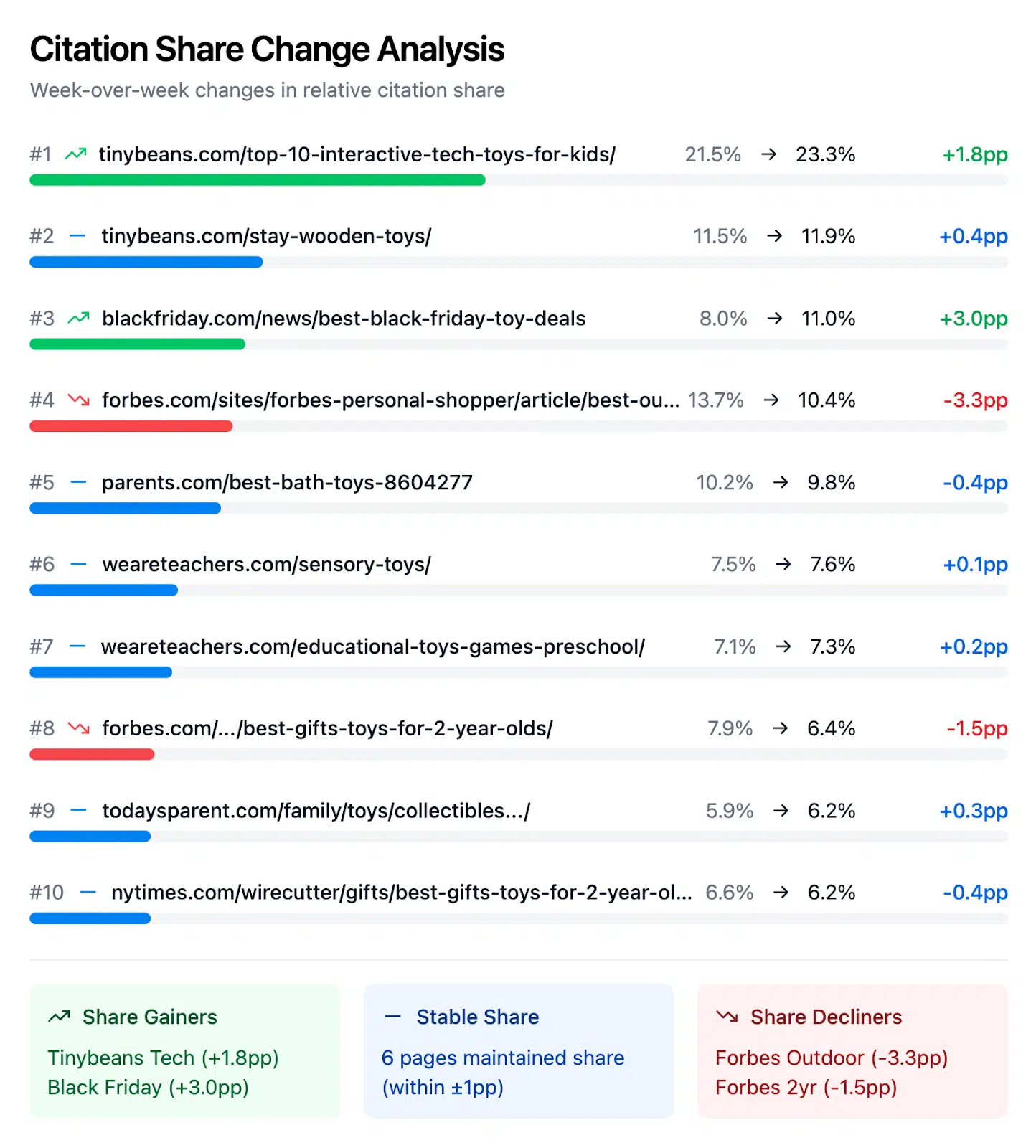

When you track the citation change over time, you can see the volatility:

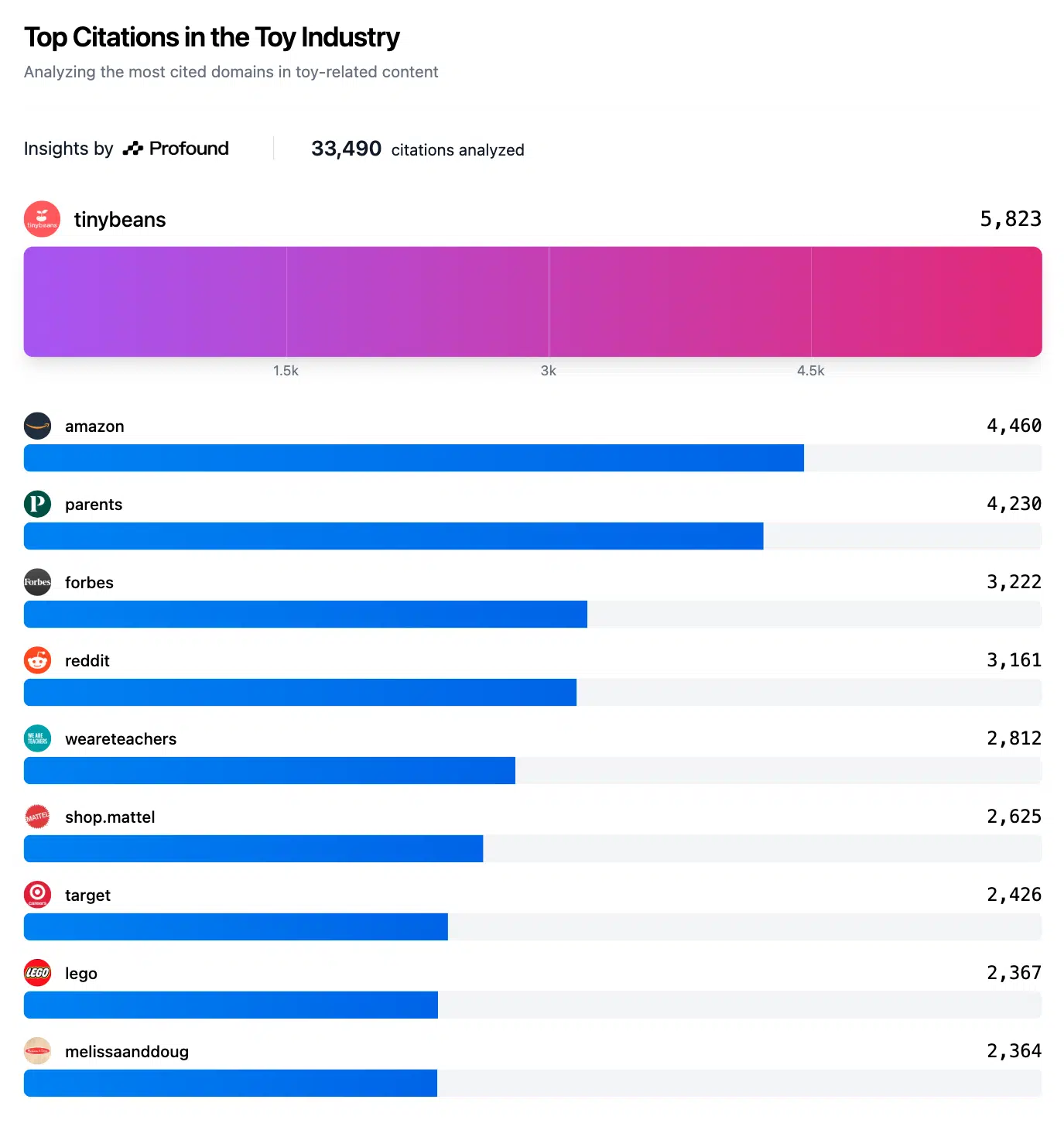

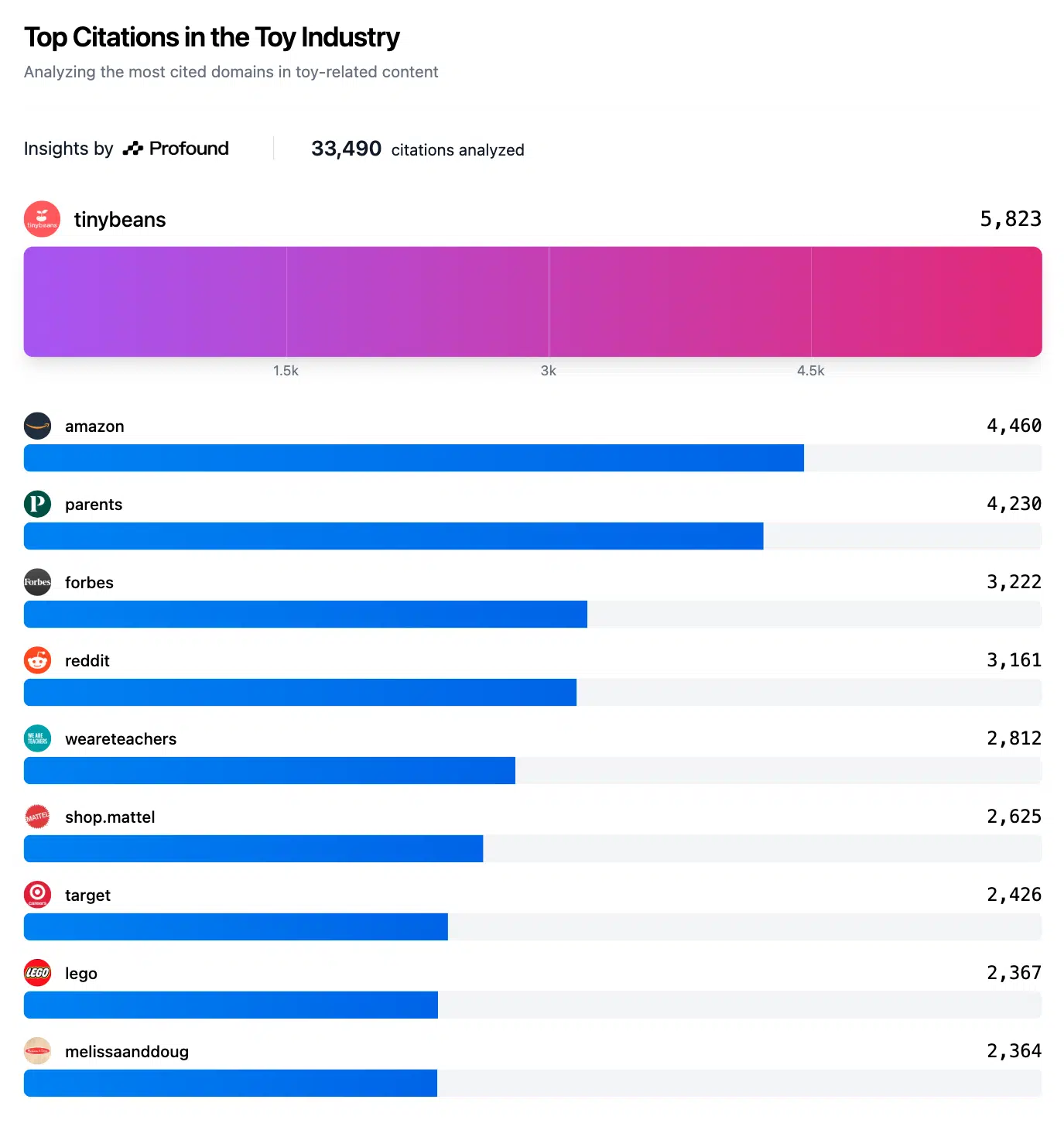

Despite the volatility, at a macro level, you can see clear trends:

- Tinybeans significantly leads the pack with 5,823 citations, more than 30% higher than the second-place Amazon (4,460). This suggests Tinybeans has established itself as the primary authority in toy-related content according to the AI search models.

- The top 10 features an interesting mix of traditional media, marketplaces, manufacturers and social platforms, with ecommerce (Amazon, Target), content publishers (Tinybeans, Forbes*, Parents) and social platforms (Reddit) all represented.

- Big brands like LEGO and Melissa & Doug appear at the bottom of the top 10. This is pretty good proof that third-party content about toys generates more citations than direct brand content.

- Tinybeans strengthened its dominance, and its two top-cited pages now control 35.2% of citations (up from 33%).

- The Black Friday deals page experienced the largest share gain (+3.0pp), jumping from 8% to 11% of citations. This dramatic shift reveals that AI models are heavily weighting seasonal relevance in citation selection.

- Both Forbes’ citations lost significant ground (-4.8pp combined), while specialized content gained visibility share. I think this could be either a result of Black Friday gearing towards focused, category-specific content over broad gift guides or Bing demoting sites like Forbes the way that Google did after its site reputation abuse manual action.

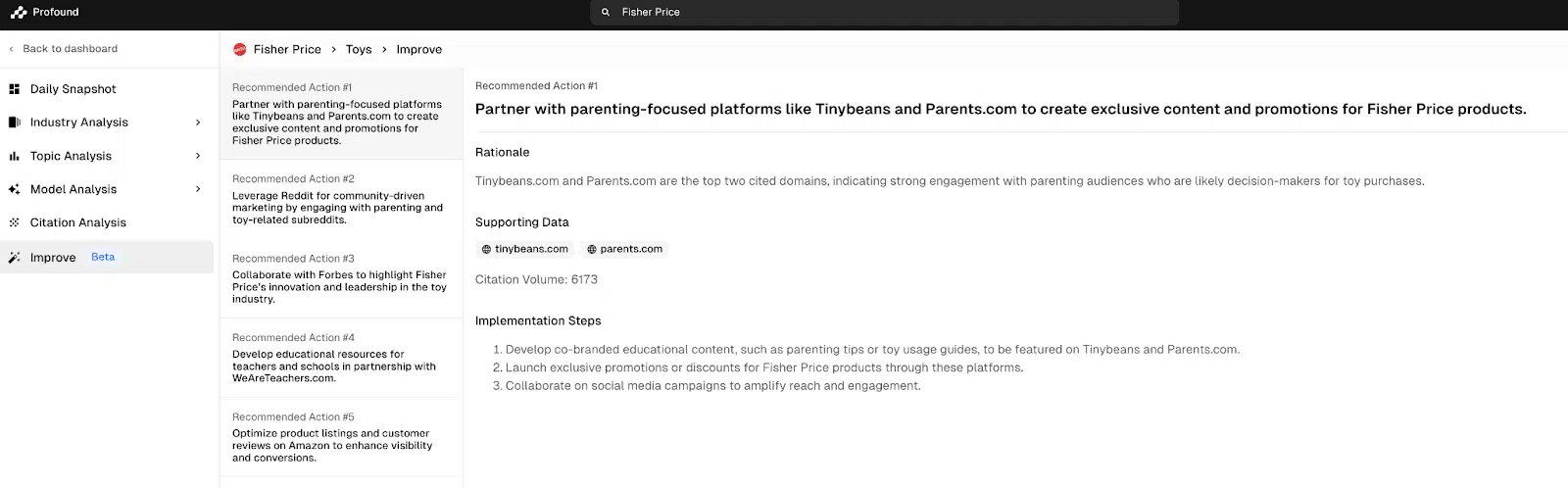

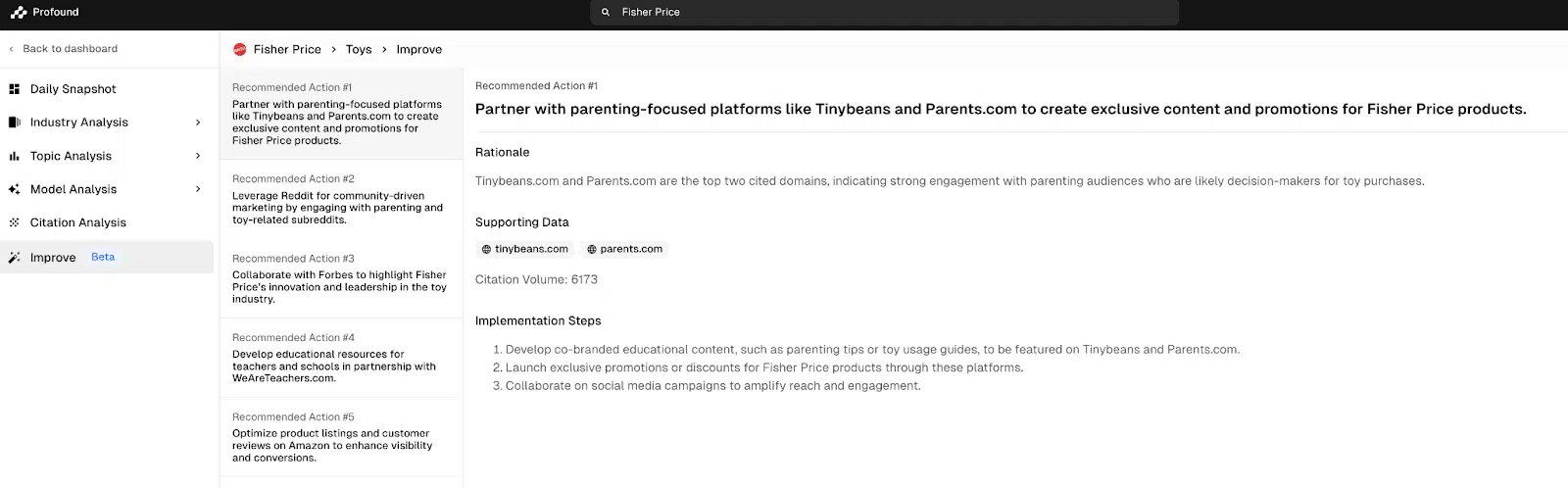

If I were Fisher-Price, I would make sure that my toys are included in Tinybeans.com’s articles (as well as Parents.com and WeAreTeachers.com).

I’d be developing that relationship and partnering with them when possible.

Profound is starting to surface those insights for content strategy, too.

The bright side is that any brand can potentially see its visibility grow immediately.

If your digital PR tactics are effective, your products can be served up by AI search results instantly.

You don’t need to earn the same type of authority required for a similar type of query on Google.

But any wins you earn could be wiped away by competitors, publishers or changes to the AI search tool that are outside your control.

It’s a double-edged sword.

In the future, brands should have an AI search channel team that operates in coordination with SEO, digital PR and content.

That team would monitor performance with a tool like Profound to report on visibility across core business topics and the citations populating them.

Right now, the most valuable thing any organization can do is put the people, processes and creativity in place to build an agile AI search team within your marketing department.

With these AI search tools, these people can pivot and adapt – and they’ll need to adapt.

The tools will change over time, and we’ll also see content teams evolve.

Most importantly, as people become more comfortable with conversational search, their queries and search methods will more naturally leverage the power of the tools.

It won’t happen overnight, but it will be faster than anticipated.

Contributing authors are invited to create content for Search Engine Land and are chosen for their expertise and contribution to the search community. Our contributors work under the oversight of the editorial staff and contributions are checked for quality and relevance to our readers. The opinions they express are their own.