Identity theft is fraud. It’s when someone illegally finds and uses your personal information to access your money. The criminals may try to hack into your bank account, apply for credit in your name (such as a home loan or store card) or use your credit card to buy things online.

Which cards come with identity theft and fraud protection?

Most credit cards come with fraud protection, but the details and processes will differ between lenders. Look on your credit card’s website to see details of its fraud protection guarantee.

To help you out, here are a few of the top identity theft protections.

There are T&Cs to fraud protection, so check the card’s PDS for specific details.

| Brand | Fraud protection | Fraud money-back guarantee | Online protection | Instant card lock |

|---|---|---|---|---|

| American Express | Fraud Control: an advanced bot that detects fraudulent transactions and notifies you by text or email immediately. You can reply Y to confirm the transaction, or call Amex to report the activity as fraudulent. | Amex will refund any lost money from fraudulent transactions as long as you didn’t contribute to or delay reporting the fraudulent transactions, and you’ve complied with the Card Conditions such as taking reasonable care to keep your card and account details safe. | American Express Safekey: confirms your identity by asking for additional information when shopping with certain merchants online, such as asking for a dynamic One-time Code sent via email or text. |  Log in through the American Express online account portal. Log in through the American Express online account portal. |

| ANZ | ANZ Falcon: 24/7 anti-fraud protection that identifies suspect transactions. ANZ will contact you to confirm the transaction and may freeze your card temporarily. | As long as you promptly notify ANZ of the fraudulent activity and didn’t contribute to any funds lost, ANZ will credit your account with the amount stolen. | Visa Secure: free services that give you extra protection while you’re shopping online at participating merchants. |  Through the ANZ App under Card > Manage > Manage Card > Temporarily Block Card Through the ANZ App under Card > Manage > Manage Card > Temporarily Block Card |

| NAB | NAB Defence: Where you see the NAB Defence logo, you’ll be protected against fraud (using your physical card or digital wallet), as long as you’re upholding your responsibilities as a cardholder. | NAB says you’ll be reimbursed the amount taken from your account if, against all its best defences, you’re a victim of fraud. | SMS Security: Provides unique authentication codes when you’re using online banking or the NAB app. It protects your accounts even if your NAB ID and password fall into the wrong hands. |  Through the NAB app under My Cards > Block card Through the NAB app under My Cards > Block card |

| Westpac | Westpac’s Fraud Detection Team will issue an SMS if any unusual activity is detected. | As long as you have not disclosed security information including your PIN and have met card conditions around security. | Digital Card Security: the 3-digit security number for your digital wallet (and online payments) refreshes every 24 hours to keep your details safer. |  Through the online banking portal or Westpac app under Cards > Lock card temporarily Through the online banking portal or Westpac app under Cards > Lock card temporarily |

| Citi | Fraud Early Warning: Citi monitors your spending to spot unusual or high-risk transactions. You’ll be issued a Two-Way Alert SMS to confirm the transaction. | As long as you have not disclosed security information including your PIN and have met card conditions around security. | Use biometrics such as facial recognition and fingerprint technology to keep your online information secure. |  Through the Citi Mobile App under Card Settings > Lock card Through the Citi Mobile App under Card Settings > Lock card |

How does identity theft affect you?

Besides giving you a punched-in-the-gut feeling, identity theft can have real-world ramifications. If fraudsters apply for loans in your name, including home loans, personal loans, mobile phone plans or credit cards, and then default on those loans (which they will), the black marks will be recorded on your credit report.

Defaulted payments are kept on file for two to five years, and every lender who checks your credit profile will see them. That can affect approval for your own loan down the track.

Identity theft also means you’ll need to do a complete audit of all your accounts, change passwords and use better password protection, such as two-step authentication.

How you can protect against credit card fraud?

Fraudsters can use information from your driver’s licence, birth certificate, or passport to access money or credit, or they can get hold of your debit or credit card details.

As convenient as online spending and tap-and-go payments are, it’s also opened up a world of opportunity to fraudsters. Now, thieves can buy anything under $100 with a simple tap or swipe, with no PIN or card verification necessary.

For example, recently I helped someone who had their credit card stolen and watched in real-time as the thief made six transactions (all under $100, sometimes two transactions in one store) at pet stores, supermarkets and petrol stations. Clearly, the criminal life is hard work because the bandit also indulged in $65 worth of pizza.

Luckily, the victim was able to contact his bank, which put a freeze on his card (some apps allow you to do this instantly, such as the Citi Mobile App). His money was reimbursed under the fraud protection guarantee on his credit card, and the criminal was eventually tracked down thanks to store security cameras.

The pizza was never recovered.

You can reduce your chances of having your identity stolen by following some basic security rules:

- Shred any letters or documents with your name and personal info on them before throwing them away

- Put a lock on your mailbox

- Keep an eye on your bank and credit card accounts for purchases you didn’t make.

- Avoid public WiFi if you’re checking your bank accounts or buying something online.

- Use highly rated security software on your computer, particularly one with extra security features for online banking and spyware protection.

- Update banking passwords to a stronger, longer password with a combination of letters, numbers, capitals and special characters.

- Never share personal information on social media or via email, text or messenger.

- Watch out for messages on WhatsApp, Facebook Messenger and Instagram pretending to be a family member or asking for money.

- Choose credit and debit cards with a microchip (a Chip Card) if possible, as they’re even more secure than magnetic stripe cards.

- Don’t click links on SMS or emails asking for you to login or share any personal information (called phishing).

Looking out for phishing scams

We all learnt a lesson from the Optus data breach in September 2022 about being careful with our personal data. But fraudsters took it a step further, using text messages to phish vulnerable people caught up in the breach and pretending to be from Optus or their bank.

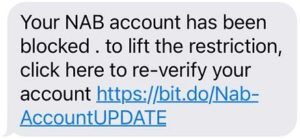

Email phishing or SMS scamming (called SMishing) is a popular way for criminals to access your data by pretending to be a legitimate message, getting you to click a link and enter your details. Here are some examples:

Phishing is getting even more sneaky because fraudsters can mimic the bank’s phone number and name, so their message shows up in the same conversation as legitimate messages from your bank.

It’s important to know that banks will never:

- Ask you to click a link in an email, text message or Whatsapp so you can confirm or update personal information or transactions.

- Ask you to transfer money to another account.

Most banks have a page on their website with the latest security alerts and scams, so you can check any messages you receive with the bank’s name on it first.

If in any doubt, don’t click. Call your bank first. If you’re not sure about a phone call purporting to be from your bank, hang up and call the bank to check. They won’t be offended.

Using fraud protection on your credit card

Fraud protection is part of the terms of your credit card (remember, it’s in the bank’s best interest to keep fraud to a minimum, too!). You may have the option to register for extra security features such as NAB’s SMS Security.

If you think your account has been used fraudulently, contact your card issuer immediately. Most times, you can put an instant lock on your card to stop any further transactions through your card’s app or online portal.

From there, the process can differ between credit card companies but typically involves an investigation into the fraudulent activity, and then a reimbursement if it’s agreed you’re not liable.

A note about microchips: many credit card companies are updating to CHIP technology, which stores your data on a microchip embedded in the card rather than on the magnetic stripe. If chip cards are available with your credit card provider, you’ll be issued one when your card is up for renewal.

What to do if you’ve been scammed or had your identity stolen

- Contact your credit card issuer (this includes the loss of your card, too)

- Work with your card issuer and the police to open a case for fraudulent activity against your name.

- Get a credit check done to see if any damage was caused to your credit score. Contact any institutions that have recorded a default from a missed payment that was related to the fraud.