Signing on the dotted line screams big commitment for a buyer and good news for a seller.

The amount of deals a business can successfully close is obviously a key value to measure for B2B companies. It indicates that your sales team efficiently reels in valuable customers, earns their trust, and gets them to buy your solution.

But what about the typical value behind those closed-won deals? When a contract is signed, how do you assess the financial impact on your business? This is where annual contract value (ACV) comes into play, helping you understand what to expect from each contract.

Use a sales performance management tool to monitor your sales progress and course correct.

What is annual contract value?

Annual contract value (ACV) is the average annual revenue generated from each customer contract, excluding any one-time fees. It’s primarily utilized by software-as-a-service (SaaS) companies that offer solutions through annual or multi-year subscription plans.

Measuring ACV by itself doesn’t offer that much value to businesses. It’s most commonly compared against other sales metrics that are related to expenses, like customer acquisition cost (CAC). If you compare ACV and CAC, you can see how many contracts need to be signed to generate enough revenue to cover the cost of acquiring customers.

How to calculate ACV

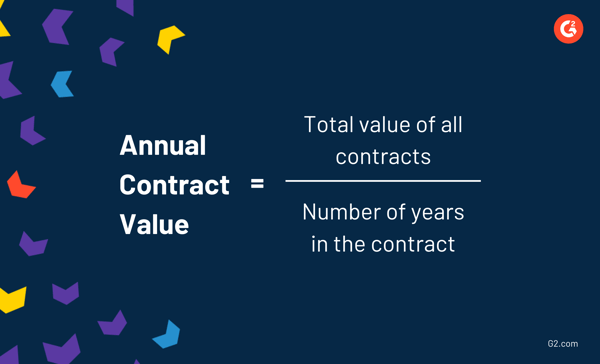

Annual contract value includes the value of all revenue from subscriptions normalized across one year. To calculate your ACV, take the total value of all of your contracts and divide that number by the total number of years in the contract. The ACV formula is as follows:

Additional ACV factors

Unfortunately for those looking for perfect consistency in every sales metric, ACV doesn’t provide that. Each business might have their own individual method of calculating ACV.

Some might use the basic equation given above, but others might take the following values into account:

- One-time fees: Things like training, onboarding, and implementation fees also generate revenue for a business, so some might include it in their ACV calculation. Since these fees are only paid once in the first year of the contract, the ACV for businesses that take these fees into account will be higher in Year 1 than in Year 2, 3, and so on.

- Expansion: Acquiring new customers can result in the profit you gain from them increasing over time through up-selling and cross-selling techniques.

- Churn: The loss of existing customers devalues your investment of acquiring them.

Calculating annual contract value: examples

With that formula in mind, let’s look at an example of how to calculate ACV with both a short-term and long-term customer.

Your long-term customer, Fake Company 500, has signed a 5-year contract with your business worth $125,000. Fake Company 500 will pay an annual fee for your solution. The ACV for Fake Company 500 would be $25,000 per year.

$125,000 / 5 years = $25,000 per year

Say you have another customer, Real Company ABC, that’s more interested in a short term commitment. They signed a 6-month contract worth $4,000 and will be making payments monthly. Since ACV is averaged over the year, as opposed to the length of the contract, the ACV for Real Company ABC is $4,000 per year.

$4,000 / 6 months = $4,000 per year

The best way to find your ACV across all current customer accounts is to do so while comparing it to annual recurring revenue, which will be discussed next.

Why is ACV important?

Because it’s simply an additional method for representing revenue in some way or another, average contract value isn’t that great of an insight standing alone. Businesses measure ACV to see how they’re performing in other key areas – a popular one being CAC.

CAC is the cost associated with convincing someone to purchase your solution. Comparing revenue-adjacent values against CAC is an effective way to measure the profitability of a business. For example, businesses will compare CAC to customer lifetime value (CLV) and determine if the value of a long-term relationship with a customer is enough to account for the cost of acquiring them.

The comparison of ACV and CAC asks the question: “How many deals do I need to close to cover my customer acquisition cost?”

Because ACV is averaged across all current subscriptions, it offers insight into how many deals a business needs to close to make a certain amount of money. Businesses will look at CAC and determine how many deals they need to close to cover it (based on ACV).

For the reason stated above, ACV is also used when setting revenue goals. Businesses will take annual contract value and conversion rate into account when forecasting revenue for a certain time period.

For example, if your ACV is $10,000 and your sales team hovers around 4 deals a quarter, you can project that your business will generate an estimated $40,000 in revenue that quarter.

Tip: Acquiring new customers is tough, and you don’t want to waste money trying to reel in people who aren’t even interested. G2’s Buyer Intent Data can show you the companies researching your business, so you can reach out to the right person at the right time.

Annual contract value and other SaaS metrics

In addition to ACV, there are other key subscription metrics in the SaaS space that help businesses understand their revenue streams and growth potential. Let’s dive into annual recurring revenue (ARR) and total contract value (TCV), and see how they complement ACV to give a full financial picture.

ACV vs ARR

Annual contract value and annual recurring revenue are seen as cousins in the sales world. Because the definitions are so similar and the values can sometimes mirror each other, annual contract value and annual recurring revenue are often confused for one another. Let’s set the record straight.

ACV is the average amount of money being generated from subscription-based activities for that year. ARR is the value of recurring revenue of a business’ subscriptions for a single calendar year. Essentially, it’s the yearly income from one subscription.

When only one customer’s ARR and ACV are being measured, they’re often the same value – the amount of money that a business will make from that customer for the year. Things get a bit more confusing when looking at total ACV vs ARR.

ACV vs ARR example

The best way to show an example of ACV and ARR is to work with multiple customers and measure values over multiple years.

Let’s break it down by customer and then show the combined total ACV and ARR for this business, using Fake Company 500 again.

Customer A agrees to a $2,000 contract for one year. They will pay Fake Company 500 annually. Since the value of the contract is $2,000 and the number of years in the contract is one, ACV is $2,000. Because Fake Company 500 will be receiving $2,000 in revenue for the year from that customer, ARR is $2,000.

ACV: $2,000

ARR: $2,000

Customer B agrees to a $1,600 contract for two years. They will pay Fake Company 500 annually. Since the total value of the contract is $1,600 and the total number of years in the contract is two, ACV is $800. Because Fake Company 500 will be receiving $1,600 in revenue across two years, ARR is also $800.

ACV: $800

ARR: $800

Customer C agrees to a $1,200 contract for three years. They pay Fake Company 500 annually. Since the total value of the contract is $1,200 and the total number of years in the contract is three, ACV is $400. Because Fake Company 500 will be receiving $1,200 in revenue across three years, ARR is also $400.

ACV: $400

ARR: $400

Now, that might not look like much and you might be a bit confused. Bear with me! Once we do a final calculation for the year that takes all three customers into account, the difference between ACV and ARR will make a lot more sense.

ARR example

Let’s start with ARR. To calculate ARR, simply add the value from each contract that Fake Company 500 will be receiving that year.

In Year 1, Fake Company 500 will receive $2,000 from Customer A, $800 from Customer B, and $400 from Customer C, resulting in $3,200 in annual recurring revenue.

$2000 + $800 + $400 = $3,200

At the end of Year 1, Customer A’s contract has ended, so they’ll no longer be paying a subscription. In Year 2, Fake Company 500 can expect another $800 from Customer B and $400 from Customer C. Their ARR for Year 2 would be $1,200.

$800 + $400 = $1,200

In Year 3, Customer C is the only one remaining with a contract. Since they pay $400 a year, the ARR for Fake Company 500 would be $400 for Year 3.

ACV example

Now let’s take a look at ACV.

In Year 1, Fake Company 500 will generate $2,000 in revenue from Customer A, $800 from Customer B, and $400 from Customer C. There are three contracts in question, so Fake Company 500’s ACV for Year 1 is $1,067.

$2,000 + $800 + $400 = $3,200 / 3 = $1,067 per year

In Year 2, just like with ARR, Fake Company 500 will only be generating revenue from Customer B, who will pay $800, and Customer C, who will pay $400. The ACV for Year 2 would be $600.

$800 + $500 = $1,200 / 2 = $600 per year

In Year 3, Fake Company 500’s only customer is Customer C. Since they pay $400 a year, the ACV for Year 3 would be $400.

$400 / 1 = $400 per year

Total contract value (TCV)

When speaking on ACV, it’s important to touch on total contract value as well.

TCV refers to the total value of a contract, including fees and recurring revenue. ACV is a good value to measure when determining which customer is offering the most consistent income, but TCV tells you which contract is the most valuable overall.

To calculate TCV, simply add the total recurring revenues from the contract to the additional contract fees. For example, if you close a deal with a $100 onboarding fee and a $20 a month subscription for 12 months, your TCV will be $340.

$100 + ($20*12) = $340

ACV for SaaS businesses

Annual contract value is a highly valued metric for SaaS businesses. Because their main source of revenue is licensing software using contracts, the typical value associated when closing a deal will affect the rest of the business.

SaaS businesses like to understand the benchmark value of any metric for their industry and ask questions like, “What is a good ACV for my business?” And of course, the answer is that it depends. Businesses can be successful with both high and low ACVs.

Because the key purpose of ACV is to act as a value to compare other metrics against, the answer depends on the value of that second metric. As mentioned above, the most common metric to compare ACV with is customer acquisition cost. If your business has a low CAC, then an ACV on the lower end is alright. As long as your ACV can outweigh your CAC, you’re in good shape.

Think about a business like Adobe, whose products can be sold to individual consumers. When selling to this audience, the ACV is going to be low because one license is being sold to one consumer, but since the cost of acquiring new customers is also low, the business can still be profitable.

On the other hand, there are businesses like HubSpot that sell to entire companies. Since HubSpot’s solutions are more expensive and involve a longer sales cycle, their CAC is going to be quite high. However, their ACV is also quite high, so they can still see a profit.

It’s important to stay focused on your business and your business alone when thinking about what a “good” ACV is.

How to increase SaaS ACV

Now that you know how to measure your annual contract value and understand which metrics to compare it against, you might’ve realized that your ACV could use a little help.

Because ACV depends so heavily on your specific solution and business plan, it’s hard to round up a group of factors that can be changed to consistently result in a higher ACV. Something that works for one business can be completely wrong for another.

However, there are two things you can do to boost your ACV that might seem obvious, but are worth noting.

1. Focus on up-selling

As your customers and their businesses grow, so will their software needs. Finding opportunities to up-sell, which is a sales technique where a rep attempts to convince the customer to buy a more expensive solution, is a great way to increase the value of your average contract. More money equals more value.

However, you need to be careful when up-selling to your customers. Yes, it’s your job as a sales rep to close deals for your business and generate as much revenue as possible, but you are also there to serve the customer. If they feel pressured to make a purchasing decision they aren’t ready for, you could lose their business altogether.

Gain a deep understanding of their business, watch for growth, and present the opportunity when it makes the most sense for them, not you.

Tip: The best way to up-sell is to understand your customers and anticipate their needs. CRM software can help you build that necessary relationship, so when the time comes for them to upgrade to a new solution, you’ll be ready.

2. Raise your prices

This one can’t be elaborated on too much – raising your prices will increase your ACV. Again, more money equals more value.

While the idea is simple, the process of doing so isn’t. When raising prices, there are some things that will make your customers angry and stingy with their wallets. Not giving them enough notice or tricking them into signing a contract without pointing out the price change can result in those customers walking away without a second thought.

You might be able to get away with raising your prices, but never ever do so maliciously. Treat your customers the way you like to be treated as a buyer.

Don’t sleep on annual contract value

Annual contract value is an often overlooked and underestimated sales metric. While it doesn’t mean much standing alone, comparing ACV against other values provides valuable insights when making business decisions.

Stay informed by getting a good grip on what ACV makes sense for your business and never lose sight of it – or you might suffer the consequences.

ACV can be used to inform a lot of other parts of your selling strategy, including quotas. Learn how to set sales quotas that align with your ACV, benefit the business, and motivate your reps.

This article was originally published in 2020. It has been updated with new information.