Over the past several years, we’ve been entirely focused on high mortgage rates.

The 30-year fixed surged from sub-3% levels to around 8% in the span of less than two years.

This obviously got the attention of everyone, whether it was the media or everyday Americans.

But often it felt like home prices were overshadowed by interest rates, despite also surging higher.

In the United States, home prices have risen nearly 50% since just 2019, and have basically doubled since bottoming a decade ago.

We’re Focused on Mortgage Rates, But What About Home Prices?

I get it, the rise in mortgage rates was unprecedented. While they only went up to around 8% this cycle, the increase in such a short period is record-breaking stuff.

For context, the 30-year fixed went from about 3% to 8%, which is a 167% gain, from early 2022 to late 2023. That’s an extremely small window of time to see such an increase.

Conversely, the 1980s mortgage rates went from 9% to 18%, only a 100% increase. And it took four years. They only didn’t stay that high for more than a few months before retreating back to the low teens.

Either way, it’s clear mortgage rates have been top of mind for everyone because of this dramatic rise.

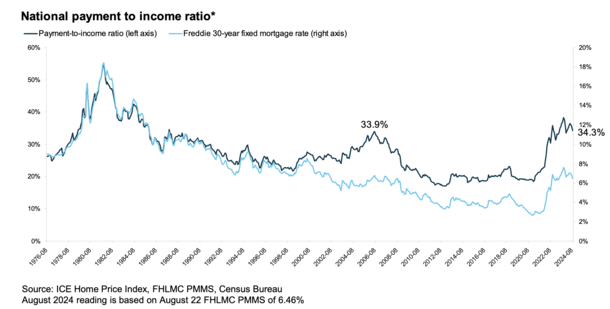

And the higher rates have had real implications. Housing affordability was historically okay prior to the mortgage rate run-up, but quickly surpassed the early 2000s housing bubble peak late last year, per ICE (see chart below).

Affordability has since improved a bit as rates have decreased, but it remains pretty poor and using 2008 as a yardstick probably isn’t prudent.

But the point I’m trying to get at here is it’s not just the rates. As I pointed out last week, we have a high loan amount problem as well.

Let’s Consider a Home That Is Currently for Sale Near Me

I got the idea for this post after receiving a text message about a home for sale nearby.

It was one of those unsolicited text messages from a real estate agent advertising their listing.

These always pique my interest because they provide a quick housing market temperature.

The property in question is selling for about $1.7 million, which immediately seemed steep for the area. But it’s also not an outlier given how much prices have risen.

The breakdown on Redfin was a monthly PITI payment of roughly $11,200. That assumed a 20% down payment (only about $340k!) and a 7% 30-year fixed mortgage rate.

One you throw in homeowners insurance and property taxes, you’re looking at a pretty steep five-digit payment. Ouch!

Now I wanted to get context so I looked at properties nearby the subject, and found one that was backed up to it and fairly similar.

Sure, not as updated and a little smaller, but still close enough for me. The current homeowners purchased it in 2015 for about $750,000.

Right off the bat, we’re talking about a property that is double in price, despite backing up to one another and being fairly similar.

That means the increase in PITI goes beyond just a higher mortgage rate. And don’t forget the massive down payment either.

The same 20% down on the comparable property was just $150,000. As for the PITI, only $3,700!

That’s a difference of $7,500, or a percentage increase of 200%!

Comparing Monthly Payments Across Different Mortgage Rates

| $1.7M Home Purchase | Monthly PITI |

| 7% rate | $11,200 |

| 6% rate | $10,300 |

| 5% rate | $9,450 |

| 4% rate | $8,700 |

Let’s just ignore the fact that the price is the price and look at different payments with various mortgage rates.

At the 7% 30-year fixed that Redfin is using by default, the monthly PITI is $11,200. We knew that already.

But what about a rate of 6%? Still a whopping $10,300 per month, or nearly triple the comparable property.

At 5% we get a monthly housing payment of $9,450. At least it’s not in the double-digits anymore, right?

And finally, at a rate of 4%, which is pretty darn low, the PITI is still $8,700 per month! That’s still 135% higher than the comp home.

So basically if mortgage rates returned to near-record lows, the payment is still pretty astronomical compared to the home buyer who purchased a like property less than a decade earlier.

If you want to say hey, it’s been nearly 10 years, that’s an unfair comparison. I see similar properties purchased in 2017, 2018, and 2019 for about $850,000 or $900,000.

Simply put, home prices alone have put affordability out of reach for many. And the higher mortgage rates we’re just an insult to injury.

Do We Have a High Home Price Problem?

As illustrated, even a 4% mortgage rate doesn’t bring mortgage payments down enough to make a home purchase affordable for many.

Paying nearly $9,000 per month while your neighbor is paying $3,700 seems pretty ridiculous.

So the next most obvious place to look is home prices. But we know that home prices are sticky and rarely fall, at least on a nominal (non-inflation adjusted) basis.

This means it’s hard to get much relief there unless there a meaningful uptick in supply, which could lead to lower prices.

But that brings up the other reason why home prices are so high to begin with. There has been a severe lack of existing home supply for years in many markets nationwide.

And it only grew worse when mortgage rate lock-in reared its ugly head. The one bright spot might be rising wages, which take some bite out of the price increase.

However, it’s not enough on its own. You need all three components to restore affordability, including rates, prices, and wages.

Sure, mortgage rates and home prices can come down together, and they might need to in order to restore affordability.

Read on: It’s no longer a mortgage rate story.