Lately, there’s been a ton of speculation surrounding the direction of mortgage rates.

I too have taken part in this quite a bit as I’ve attempted to determine what’s next for rates.

Despite the recent increase in the 30-year fixed from around 6% to 7%, I have remained bullish that they remain in a downward trend.

Really, I haven’t changed my view since they began to fall about a year ago when they appeared to top out at 8%.

Many other economists and pundits have flip-flopped since the Fed first cut rates in September, but that might prove to be a mistake.

Mortgage Rates Tend to Move Lower Before a First Fed Rate Cut

The first Fed rate cut this cycle took place on September 18th, with the Federal Reserve opting for a 50-basis point cut to its federal funds rate (FFR).

This marked the “pivot” after the Fed raised rates 11 times beginning in early 2022 to combat inflation.

The reason they finally pivoted after increasing rates so much was because they felt inflation was no longer a major concern, and that keeping rates higher for longer could affect employment.

Their dual mandate is price stability and maximum sustainable employment, the latter of which could suffer is monetary policy remains too restrictive.

Anyway, that led to their first rate cut and much to everyone’s surprise, the 30-year fixed climbed about a full percentage point since, as seen in the chart from MND above.

Many people believe the Fed controls mortgage rates, so that when they “cut,” rates on home loans would also come down.

This is a longstanding myth and one that has proven hard to shake, but perhaps the recent movement in mortgage rates will finally put it to bed.

After all, the 30-year fixed was around 6.125% on September 18th, and quickly climbed as high as 7.125% in early November.

So perhaps folks will stop believing that the Fed controls mortgage rates.

However, mortgage rates do tend to move in the same general direction as the federal funds rate.

Why? Because although the FFR is a short-term rate, and the 30-year fixed is obviously a long-term rate, the Fed cutting rates typically signals economic weakness ahead.

And weakness means a flight to safety, aka investing in bonds, which increases their price and lowers their yield (interest rate).

Mortgage Rates Reacted Fairly Normally to the Fed Rate Pivot

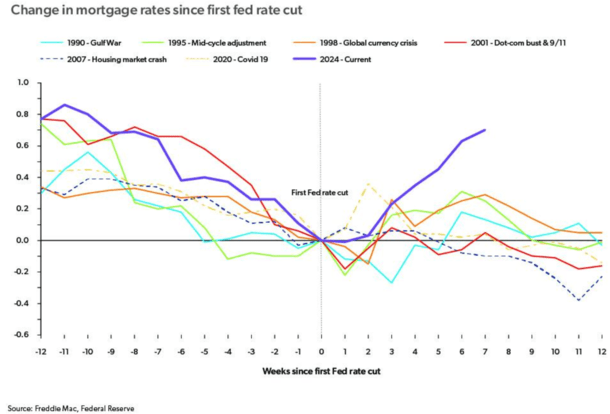

Check out this chart from Freddie Mac, which details mortgage rate movement 12 weeks before and 12 weeks after the first Fed rate cut.

While it appears that 2024 is out of character, when you consider that rates fell about 80 bps leading into the cut, a rebound wasn’t totally unexpected.

Because much is baked into a Fed cut, rates often bounce a bit once the news is delivered. It’s a classic buy the rumor, sell the news event.

Also consider that a strong jobs report was released shortly after the Fed’s policy decision, which had a big impact on rates.

So it also depends what happens to take place around the same time. What if that jobs report was weaker-than-expected? Where would we be today?

Anyway, there were instances in the past when mortgage rates followed a similar path, including in 2020 and 1998.

In many years with a pivot, mortgage rates increased for a short period before beginning to fall again.

But most importantly, mortgage rates always fell leading into the pivot. There has always been a pre-pivot move lower.

Simply put, mortgage rates favor the expectation of a Fed pivot, which explains why once again this year the 30-year fixed fell from 7.5% in May to 6.125% in September.

Will Mortgage Rates Get Back on Track Like They Have in the Past?

Using the chart above, we can see that the 30-year fixed remains markedly higher than it did pre-Fed rate cut.

But over the past couple weeks (captured in the first chart), rates have eased a bit. The 30-year peaked around 7.125% and has since fallen to around 6.875%.

So it has gotten about 25 basis points of its move higher back and could be slated to get more.

It’ll be about 12 weeks since the Fed pivot two weeks from now, so we’re running out of time to get it all back.

However, history shows that mortgage rates do tend to at least get back to their first Fed rate cut levels in just three months.

And often move even lower beyond that, if any of the other pivots seen in the past are any indication.

It’s not to say history always repeats itself, but it would be surprising if rates don’t get back to the low 6% range again soon, simply matching levels seen in mid-September.

It also wouldn’t be a shock if they moved even lower than that over time, possibly into the high-5% range and beyond.

Again, if you look at the chart, they often continue to fall. But it will all depend on the economic data that is released, including the always-important jobs report on Friday.

Making things murkier is the incoming administration and their plans, which have put rates on a bit of a rollercoaster, and could explain why they popped so much higher lately.

Read on: What will happen to mortgage rates under Trump’s second term?