With mortgage rates surging higher again, somewhat unexpectedly, a thought came to my mind if you’re currently home shopping.

A couple years ago, I threw out the idea to adjust your maximum purchase price lower when looking for a property.

That post was driven by the many home sales that were going way above asking at the time. In other words, a home may have been listed for $600,000, but eventually sold for $700,000 in a bidding war.

That was all to do with a very hot housing market, driven in large part by a combination of record low mortgage rates and very low for-sale supply.

Today, we still have relatively low inventory, but the cheap mortgage rates have come and gone.

And now that they’re so volatile, you may want to input a higher rate into your mortgage calculator to ensure you don’t get caught out.

Mortgage Rates Are Highly Volatile Right Now

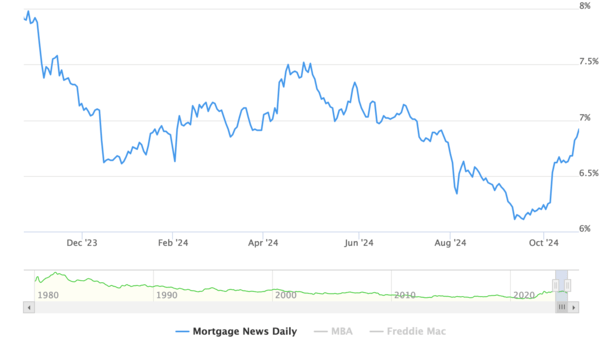

At the moment, mortgage rates are super unpredictable. While they had enjoyed a very good 11 months, falling from as high as 8% to nearly 6% in early September, they’ve since reversed course.

The 30-year fixed was nearly back into the high 5% range before the Fed cut rates and a better-than-expected jobs report arrived.

Sprinkle in some doubting about the Fed’s pivot and the upcoming uncertainty regarding the election outcome and home buyers are now facing a rate nearly 1% higher.

Per MND, the 30-year fixed has risen from a low of 6.11% on September 17th to 6.92% as of October 23rd.

Talk about a rough month for mortgage rates, especially since many expected the Fed’s rate cutting campaign to be accompanied by even lower mortgage rates.

It’s a good reminder that the Fed doesn’t control mortgage rates, and that it’s better to track mortgage rates via the 10-year bond yield.

Also, those yields are driven by economic data, not what the Fed is doing. By the way, the Fed makes moves based on the economic data too. So follow the economic data for crying out loud!

Anyway, this recent move up serves a great reminder that mortgage rates don’t move in a straight line. And to expect the unexpected.

Err on the Side of Caution By Inputting a Higher Mortgage Rate

If you’re currently looking to purchase a home, it’s generally a good idea to get pre-qualified or pre-approved upfront.

That way you’ll know if you actually qualify for a mortgage, and at what price point, including necessary down payment.

The thing is, these calculations are only as good as the inputs. So if your loan officer or mortgage broker puts in overly favorable numbers, it could skew the affordability picture.

In other words, you almost want to ask them to put in a mortgage rate that is 1% higher than today’s market rates.

That way you can absorb a higher payment if rates happen to worsen during your property search, which can take months and months to complete.

If rates happen to fall during that time, wonderful, it’ll just be the icing on the cake. Your expected monthly PITI will be even better than expected.

But like those bidding wars that took place, which resulted in higher asking prices, unexpected spikes in rates should also be anticipated.

And if they are, you might look at properties that are more within your price range, as opposed to homes that only work if everything is just right.

Given that homeowners insurance and property taxes are also on the rise (with just about every other cost), it can pay off to be prudent with your proposed home buying budget.

Adjust the Mortgage Rate on the Property Listing Page

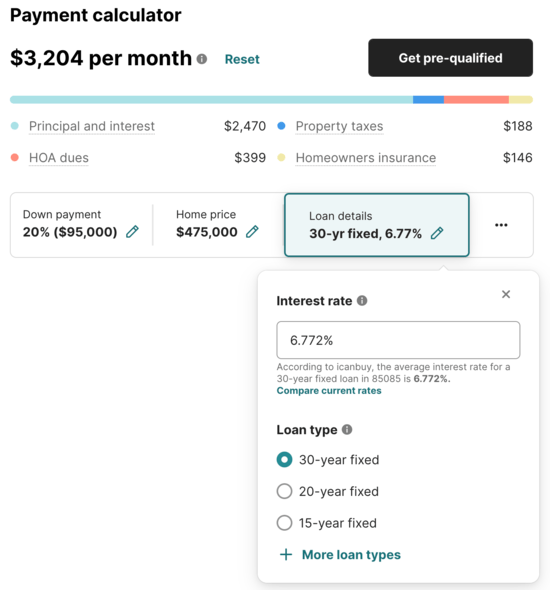

If you’re using a site like Redfin to browse listings, there’s a handy mortgage payment calculator on each listing page.

It provides default amounts based on typical down payments, mortgage rates, property taxes, and homeowner insurance.

Let’s say that interest rate is 6.77% today, which is pretty reasonable given current market rates.

If you click on the little pencil icon, you can change it to anything you want. You can also select a different loan type while you’re at it.

Once you do, it tends to save your inputs, so when you look at other properties, the rate you selected earlier should apply to other homes.

This can give you a faster, perhaps more realistic estimate of the monthly payment, instead of a rate that might turn out to be too good to be true.

So you could put in 7.75%, or maybe 7.50%. That way if rates go up, or you qualify for a higher rate thanks to some loan-level price adjustments, you won’t be caught off guard.

You’re basically playing it more conservatively in case pricing worsens, which is the prudent approach.

While you’re at it, you may want to review the other inputs to ensure they are reflective of your proposed loan.

Are you really going to put 20% down on the home purchase, or just 3% to 5%?

Overestimating these costs instead of potentially underestimating them can help you avoid being house poor. Or worse, missing out on your dream home entirely due to inaccurate estimates.