IndusInd Bank offers two credit cards to its affluent customers as part of their Pioneer banking program: the Pioneer Heritage Metal Credit Card (Super Premium) and the Pioneer Legacy Credit Card (Premium).

Here, we’ll take a closer look at the IndusInd Bank Pioneer Legacy Credit Card that offers decent rewards and benefits.

Overview

| Type | Premium Credit Card |

| Reward Rate | 1% – 3% |

| Eligibility | Pioneer A/c (30L NRV) |

| Best for | Weekend Spends |

| USP | Redeem points for Stmt. Credit |

Even though it is only a Premium Credit Card, it is intended only for High Net-Worth Individuals (HNI’s) with an IndusInd Pioneer Banking account.

The target segment for this card is relatively small, as most HNI’s would prefer a super-premium credit card instead.

Joining Fees

| Joining Fee | INR 5,000+GST |

| Joining Fee Waiver | Spend INR 50,000 in 90 days |

| Renewal Fee | Nil |

While the card used to be offered as a Lifetime Free Card for Pioneer customers, it seems they’ve slightly modified the pricing recently by asking for a minimal spend requirement for the joining fee waiver.

But as you might know, IndusInd Bank usually has multiple pricing plans, so LTF might still be available.

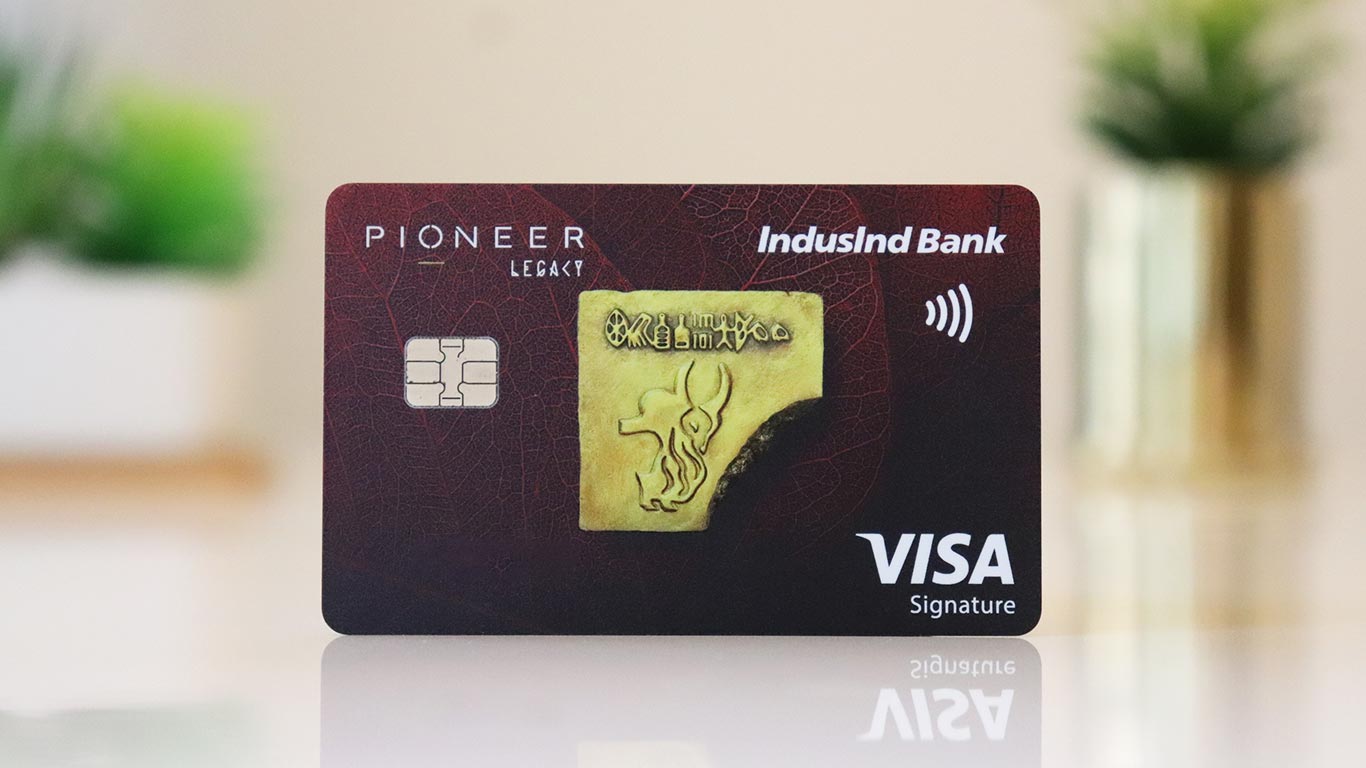

Design

The design is undoubtedly beautiful, much like most other IndusInd Bank credit and debit cards offered under the Pioneer banking program.

While the Visa variant is attractive, the Pioneer Legacy Mastercard variant is even more beautiful.

Rewards

| SPEND TYPE | REWARDS | REWARD RATE (CASH CREDIT) |

|---|---|---|

| Weekend Spends | 2 RP / 100 INR | 2% |

| Weekday Spends | 1 RP / 100 INR | 1% |

| Select Categories* | 0.70 RP / 100 INR | 0.7% |

- 1 Reward Point = 1 INR (for cash credit)

- Select Categories: Utility, Insurance, Government Services, Education, Rent.

As you can see, weekend spends makes the card useful for many. And the option to redeem points for statement credit at 1:1 is quite good to have.

IndusInd Legacy was not having the category restriction (low rewards) for sometime but then it was added as well eventually.

Milestone Benefit

| SPEND REQUIREMENT | MILESTONE BENEFIT | Reward Rate |

|---|---|---|

| 6,00,000 INR | 6,000 RP’s | 1% |

Milestone benefit gives a nice 1% gain on 6L spend, thereby increasing the total reward rate to 2% (weekday spends) or 3% (weekend spends), depending on when the spends are made.

This makes it something similar to IndusInd Pinnacle Credit card which used to offer 2.5% reward rate in the past, before devaluation.

Airport Lounge access

| ACCESS TYPE | ACCESS VIA | ACCESS LIMIT |

|---|---|---|

| Domestic | Mastercard | 1/Qtr |

| International | Priority Pass | 2/Qtr |

I wonder why domestic limit is too low for a premium credit card, international access limits are fair enough though.

That said, one good thing with IndusInd Premium Credit Cards is that they’re acceptable in most lounges, especially in the popular 080 Lounge in BLR – Terminal 1, as I have seen couple of people using IndusInd Pioneer credit & debit cards for the access.

Golf

- 4 Games & 4 lessons per month

- Spend Requirement: 25,000 INR (in previous statement cycle)

IndusInd Pioneer Legacy Credit Card comes with pretty good Golf benefit, 2X more when compared to Pinnacle Credit Card.

The expected spend requirement to avail the Golf benefit is also fair enough, as IndusInd Golf booking system is one of the best in the industry.

Other Benefits

- Bookmyshow Offer: Buy1 Get1 offer, Upto Rs.200 per ticket, upto 3 tickets per month

- 1% fuel surcharge waiver (txn range: 500-10,000 INR)

- No Cash Withdrawal Charges

- Low foreign Currency Markup of 1.8%

- Concierge benefits

While IndusInd Bookmyshow benefit used to work wonderfully well in the past, it’s not the case lately as the quota is getting used up pretty quick.

Hands-on Experience

I applied for the IndusInd Pioneer Legacy Credit Card for a family member a few years ago as it was anyway a lifetime free card with a beautiful design.

However, it took a month to receive the card due to the physical application process. But I heard that IndusInd Bank recently moved to 100% digital application process, so one can expect the card in about a week or two.

But I continue to hope that IndusInd and other banks implement a super-fast & simple application process for their Premium Banking customers, similar to the one offered by Standard Chartered Bank for their SC Priority customers.

With Standard Chartered, all it takes is an OTP to be shared with the RM to log-in the application. IDFC Bank also offers a similar system, with instant approval.

Bottomline

The IndusInd Bank Pioneer Legacy Credit Card is a reasonably rewarding card for those with a Pioneer banking relationship who are looking for a credit card with moderate spends.

It can also serve as a backup card for super-premium cardholders as it comes with a good reward rate, directly as cashback instead of travel rewards.

However, it’s not worth opening a Pioneer Banking Account solely for this credit card. There are many other best credit cards in India to choose from.

Are you using IndusInd Bank Pioneer Legacy Credit Card? Feel free to share your thoughts in the comments below.