This edition of Modern Restaurant Management (MRM) magazine’s Research Roundup features news of F&B hiring issues, fast-casual growth, guest views on AI use, and

Majority of US F&B Businesses Struggling With Labor Shortages

● Majority (82 percent) of US restaurant & foodservice businesses are actively hiring

● Nearly half (47 percent) of US F&B managers cite staff recruitment, retention & training as primary challenges

● Chefs & Cooks are the most difficult positions to fill

A recent Expert Market report sponsored by hospitality platform Toast, revealed that 82 percent of US restaurant & foodservice businesses are actively hiring. Expert Market’s survey results also revealed that labor shortages have been cited as a top concern for nearly a quarter (23 percent) of US F&B businesses, top chart. This insight highlights staffing issues as a concerning and current challenge faced by US F&B businesses.

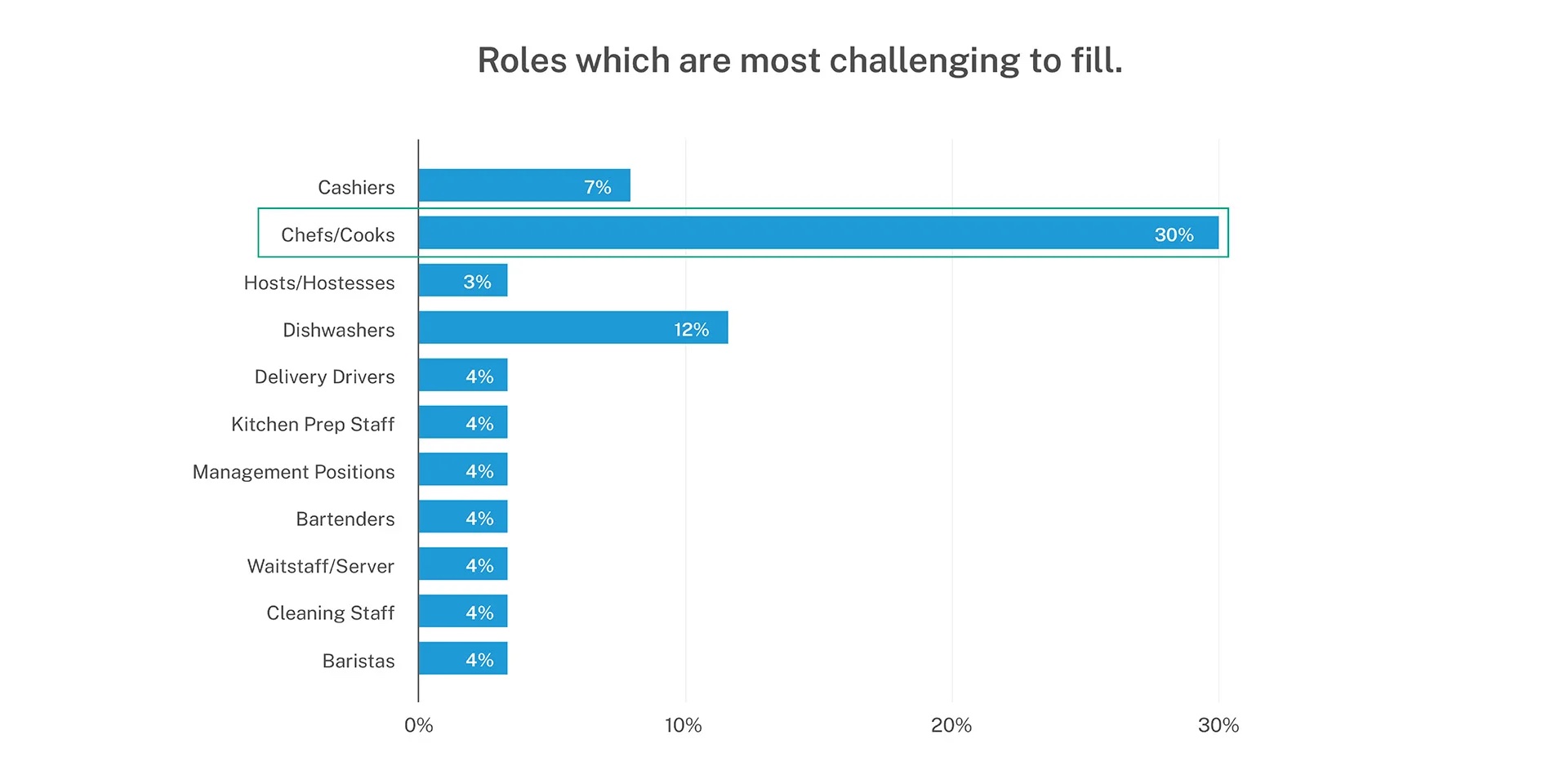

Top Three most challenging roles to fill:

- Chefs and Cooks

- Dishwashers

- Cashiers

According to the report’s findings, Chef and Cook positions emerge as the most challenging roles to fill, accounting for 30 percent of all open roles. This finding from Expert Market’s 2024 F&B Industry Report sheds light on a clear culinary gap within the industry’s workforce.

Dishwashers were found to be the second most challenging role to fill, accounting for 12 percent of all open roles. Cashiers came in third place taking up seven percent of all open roles.

Staff retention struggles

However, recruitment issues aren’t the only factor contributing to staff shortages. A 2023 study by Toast found that 30 percent of staff in the restaurant industry are at risk of leaving in the next two years, highlighting an equally concerning high turnover rate within this sector.

The future of staffing in the F&B industry

Projections suggest that the labor shortage problem could prevail into the future, as over a quarter (26 percent) of F&B businesses believe staffing shortages will only worsen over the next 12 months.

To avoid hiring shortcomings, Expert Market recommends business owners focus on implementing effective recruitment strategies. This might include offering competitive compensation packages, enhancing workplace culture, and leveraging technology that allows for more efficient hiring processes.

The survey was conducted in January 2024 among 522 US-based Food and Beverage professionals, including owners and managers from single-site establishments and small multi-site chains with fewer than 20 restaurants. This sample size ensures statistically robust and representative data for the industry.

Another Expert Market report sponsored by Toast, revealed that over half (56 percent) of US F&B business owners say managing operational costs and maintaining profitability is their main challenge.

Economic uncertainty is the second most common challenge faced by US F&B business owners, with 52 percent saying economic uncertainty is a challenge for their business.

Most common challenges for US F&B business owners:

1. Managing operational costs and profitability (56 percent)

2. Economic Uncertainty (52 percent)

3. Coping with seasonality and fluctuations in business (37 percent)

Economic instability impact on F&B businesses

This could indicate that a period of inflation in the US, initiated by COVID-19, may well have impacted small businesses in this industry. Though inflation peaked at seven percent in 2021 and has since decreased to 2.97 percent, it is yet to reach pre-pandemic levels of around 1.9 percent in 2018.

Rental increase is the biggest operating cost concern

The biggest issue cited within operating costs is rent, as 52 percent of F&B industry workers (owners included), are specifically concerned about rental increases.

This insight seems unsurprising, considering that data from April 2024 revealed 43 percent of small business owners in the US were unable to pay their full rent on time. In addition to rent increases, inflation has driven up other expenses, with 37 percent of respondents identifying ingredient cost fluctuations as their primary operational concern.

A more optimistic economic future as uncertainty decreases

Despite current woes, the food and beverage industry is optimistic about its future as predictions for 2025 suggest that concern about economic uncertainty will drop from 20 percent to 16 percent.

This optimism is not misplaced as predictions suggest that the American economy is set to pick up in late 2024 to 2025 as inflation and interest rates potentially lower. From 2023, consumer spending has been steadily increasing and is set to continue into 2025.

To prepare for a stronger economy, Expert Market suggests implementing targeted solutions like streamlined financial management software for owners and utilizing loyalty programs and adaptive measures to retain customers.

Fast-Casual Fast Growth

Rising prices in recent years have evidently been good for someone: Fast-casual restaurants.

“…Rising QSR prices have narrowed the price gap between fast food and the more premium offerings of chains like Chipotle and sweetgreen,” reads a new report from Placer.ai, titled A QSR and Fast-Casual Face-Off. It continues: “And with many fast-casual restaurants upping their convenience games with drive-thrus and other innovations, the distinction between the two segments has become increasingly muddied.” That report finds that, through the first half of 2024, fast-casual restaurants saw visit growth of 3.2 percent year-over-year, compared to 0.4 percent for QSR restaurants.

Between May and August, restaurant visits were up year-over-year — despite higher costs, according to a new white paper from Placer.ai titled Pricing Strategies Driving Restaurant Visits in 2024. The white paper finds that different chains are utilizing different strategies to bolster foot traffic — including a mix of early-dining specials and limited-time offers. The white paper also finds that a Michelin Star can be a serious boon to restaurants, too.

Key takeaways from Placer.ai’s white paper:

Foot traffic to restaurants is on the rise, led by the fast-casual segment.

Overall visits to restaurants have increased YoY for most months since January 2024. But while FSR foot traffic dipped slightly YoY during the first eight months of the year, and QSR saw just a slight YoY increase, fast-casual restaurants saw a 3.3 percent YoY jump – likely driven by the segment’s more affluent audience.

Shake Shack is thriving even as it raises prices. The fast-casual burger chain increased prices by 2.5 percent this year, but its wealthier visitor base – with a captured market median HHI of $94.3K – didn’t seem to mind: Visits were up 22.8 percent YoY in August 2024, far outpacing the wider fast-casual segment.

Texas Roadhouse is driving YoY visit growth in the face of price hikes with early dining specials. Despite price increases, Texas Roadhouse saw a 9.7 percent YoY increase in visits during the first eight months of 2024 – likely bolstered by the chain’s outsize share of 3:00 PM – 6:00 PM weekday visits. Texas Roadhouse also draws a larger share of high-traffic weekend visits than the wider FSR category.

QSR chains have been using limited-time offers (LTOs) to drive visits.

Hardee’s offered an LTO this summer, leading to a boost in loyalty among the chain’s visitors. Meanwhile, McDonald’s experienced a significant visit boost after its late June LTO launch – especially in markets with higher-than-average concentrations of “Young Urban Singles.”

A Michelin Star can shift the profile and behavior of a restaurant’s visitors. Washington D.C.’s Causa won its first Michelin Star in November 2023 – and saw an increase in the share of “Power Elite” households in its captured market, as well as a surge in the share of visitors traveling more than ten miles to visit the venue.

Holiday Dining Preferences

Tock shared its newest consumer survey, polling over 1,000 diners on their projected holiday dining preferences and habits.

Despite the up-and-down consumer spending patterns in 2024, the holiday season is bringing a wave of excitement among diners, with 68 percent of respondents planning to celebrate at restaurants or bars. Additionally, 65 percent are reporting they are pretty or extremely enthusiastic for the holiday season. Diners will be planning ahead this year, with 31 percent planning to book three to four weeks out. The expectation for advanced planning reminds hospitality operators to market holiday offerings early, while diners are making their celebratory plans.

In addition, many diners will be on the lookout for early mealtime reservations, reflecting dining trends seen over the past several years. Nearly half (49 percent) of respondents will be seeking a reservation during the 4 to 6 p.m. early bird timeslot. The demand for earlier reservations provides restaurants the opportunity to get creative when it comes to driving traffic for second and third seating’s with memorable experiences, dynamic pricing, or late-night specials.

Results also indicate that restaurants and bars should expect to see high demand for large party bookings, with 52 percent of diners planning group outings of eight or more. This presents a significant opportunity for restaurants to tap into the festive spirit and create large format or family-style experiences to capitalize on the demand.

Tock’s survey results reveal diners are continuing to seek out unique experiences when dining out this holiday season. 67 percent of diners indicate they are seeking more than a standard reservation, with themed holiday meals (44 percent) and multi-course feasts (39 percent) at the top of the list of desired experiences. Tock’s own data provides additional evidence of the positive impact this trend can have on operators, with experiences generating 30 percent higher check average than standard reservations. Tock businesses that offer more than standard reservations see an average of 80 percent more repeat guests. Notably, on average, 90 percent of guests who book an experience at a business, book another experience on a future visit.

Tock’s diner survey uncovered several more trends and areas of opportunity for restaurants this holiday season:

Leverage Increased Holiday Spending Behavior

A substantial 88 percent of diners are prepared to spend more than they would on a typical night out. Even more promising, 17 percent of diners are willing to increase their spending by 50 percent or more. Restaurants should be encouraged to explore premium offerings, special holiday menus, and unique dining experiences that justify higher price points.

Promote Reservations Well In Advance

Holiday diners are planning ahead, with 45 percent booking reservations three or more weeks in advance. Of those, 14 percent plan to book five or more weeks out. This trend emphasizes the need for restaurants to have robust reservation systems and start holiday promotions early, well before the seasonal rush begins.

Optimize Reservation Systems

Tock’s data reveals that reservations generate, on average, 40 percent more revenue per cover and 100 percent higher check averages than walk-ins. This stark difference emphasizes how critical it is for restaurants to have an efficient reservation management system that can handle increased volume and help maximize revenue during this crucial season.

Prepare to Accommodate Large Parties

Group dining is set to be a major trend this holiday season, with 52 percent of diners planning to host holiday parties of eight or more people at a bar or restaurant. This shift requires careful consideration of seating arrangements, service strategies, and menu planning to efficiently cater to these larger groups, while maintaining the quality of the dining experience.

Boost Revenue with Desserts and Add-ons

Desserts are proving to be a sweet spot for holiday diners, with 62 percent most likely to purchase dessert as an add-on for their holiday meals. Following closely are holiday-themed gifts (36 percent) and wine pairings (35 percent). These add-ons represent a significant opportunity to increase revenue and enhance the overall dining experience. Tock’s own proprietary data shows that when offered, on average, 30 percent of guests purchase add-ons, leading to a 10 percent increase in check averages.

Offer Non-Alcoholic Spirits

A significant 31 percent of diners expressed interest in festive non-alcoholic options. This suggests a changing landscape in holiday drink menus, with a growing demand for innovative and flavorful spirit-free options.

NFL Trends

With the NFL season in full swing, Toast analyzed sales data from restaurants in all 30 NFL cities throughout last year’s season to determine what game-day foods and drinks are trending.

What’s Trending: Whether fans are celebrating victories with their favorite wings or turning to a black cherry seltzer after a tough loss, NFL game days are driving major sales spikes in local restaurants from massive food and alcohol sales boosts to quirky regional favorites.

Top NFL Cities for Increased Restaurant Sales

- Green Bay tops the list with a 27 percent increase in food sales and an impressive 169 percent jump in alcohol sales on in-season Sundays.

- Cincinnati and New Orleans also saw significant boosts, with food sales up by 12 percent and 11 percent respectively on game days.

Chicken Wings Fly on Game Day

- Unsurprisingly, chicken wings continue to reign as the most popular game-day food, with a 25 percent increase in orders on Sundays during the NFL season compared to out-of-season.

Hard Seltzer Leads Alcohol Sales

- Hard seltzer has emerged as the most popular game-day alcohol, with a 47 percent sales increase. Cincinnati fans lead the charge, with a staggering 287 percent increase in seltzer sales.

- Not to be outdone,Green Bay Packers fans saw a 612 percent surge in beer sales, nearly 10 times higher than any other city.

Soup and Stew Take Over in Fall

- Whether it’s the introduction of fall weather or the Midwest’s obsession with chili Cincinnati (+78 percent),

- Wisconsin (+58 percent), NYC (+58 percent), D.C. (37 percent), and Minneapolis all saw Soup/Stew take the top spot as the most popular NFL Sunday food item.

Kansas City’s Sales Spike (Thanks, Taylor Swift?)

- Kansas City restaurant sales rose by 8 percent during the NFL season, with wine seeing a 65 percent increase in sales on Sundays. Whether it’s because of Taylor Swift’s influence or Chiefs fans celebrating in style, wine was the drink of choice for KC.

Use of AI

With QSR brands increasingly investing in AI to enhance service models, Mood Media surveyed over 1,000 US adults to help brands gauge consumer sentiment around the use of this technology in QSR experiences.

The study reveals a growing acceptance of AI while highlighting key concerns and opportunities for the industry.

Key findings include:

Adoption:

Consumers are open to AI in QSR, with 26 percent comfortable using AI bots for ordering.

Top Appeal:

Real-time order updates are the most appealing AI feature, driving app usage.

Top Concerns:

Nearly 30 percent expressed some worry about personalized ordering experiences, and nearly 40 percent wouldn’t trust AI with dietary restrictions.

AI’s Applications:

Self-ordering kiosks are the most popular AI application among consumers, while a majority believe AI will significantly reduce jobs in the QSR industry.

Consumer Priorities:

Faster service and accurate orders are top priorities for AI features.

Second Chances:

Despite negative experiences, 17 percent of consumers would give AI another try. However, nearly half (48 percent) would either avoid using AI or be less likely to visit the restaurant again.

AI’s Future:

A majority of consumers (34 percent) view AI as a “nice-to-have” innovation, but only 16 percent consider it a must-have. However, 30 percent see AI as an unwanted solution.

Recruitment Costs

Recruitics – a recruitment marketing and AI analytics platform – published their August 2024 Talent Market Index.

This report captures important shifts in talent acquisition costs across major sectors – like the trucking/transportation/logistics, food service and hospitality industries – and offers additional analysis on their respective labor market dynamics through the JOLTS report and Recruitics’ proprietary data.

Recruitment costs in food services rose by 13.10 percent this month, reflecting a steady recovery as the industry rebounds from pandemic-related disruptions. The year-over-year increase of 21.64 percent highlights consistent demand for workers, driven by inflation and consumer behavior changes. Despite some moderation in hiring pace, the sector remains competitive, pushing recruitment costs upward.

The hospitality sector saw a significant 33.80 percent drop in recruitment costs this month, following a substantial rise over the past year (+223.67 percent). This sharp decline reflects a stabilization in post-pandemic hiring after a surge in demand for hospitality workers as travel and tourism rebounded. The year-over-year increase indicates that while prices have cooled recently, the sector has significantly recovered, driving long-term demand for service roles.

South Korea’s Rising Influence in Food Service

Circana™ released new research highlighting South Korea’s rising influence on the U.S. foodservice industry. Korean restaurants, foods, beverages, and flavors are experiencing rapid growth, with the number of Korean restaurant locations increasing by 10 percent in the past year alone. The surge has been fueled by expansion across both full-service restaurant (FSR) and quick-service restaurant (QSR) segments.

Since 2018, 450 new Korean restaurant locations have opened in the U.S., with 36 percent concentrated in key markets like Los Angeles, San Francisco, and New York City. One-third of designated market areas (DMAs) still lack any Korean restaurants, marking an area ripe for opportunity in the Asian restaurant subcategory.

“As Western QSRs continue to innovate with limited-time offers, introducing Korean flavors presents a unique opportunity to tap into the growing U.S. demand for global tastes,” said Tim Fires, president, Global Foodservice, Circana. “This culinary trend is a vital part of the Korean Wave—a cultural movement that has elevated South Korean pop culture, from K-pop to K-dramas, to worldwide prominence since the 1990s, now further amplified by the reach of platforms like TikTok.”

Korean food and beverage influences gaining popularity include:

- Korean Fried Chicken: Seven Korean fried chicken chains in the U.S. total 405 locations, with a 22 percent growth compared to last year and doubling in number since 2019. Several well-known fast-food chains also offer popular Korean chicken flavors.

- Korean Corn Dogs: Five chains specializing in Korean corn dogs have a total of 242 locations in the U.S., a 52 percent increase from last year. These chains did not exist six years ago.

- Korean Ramen: Ramen exploded in popularity in 2023 after gaining popularity on TikTok, with one leading brand rising from less than 1 percent of retail ramen sales in 2022 to over 4 percent in 2024.

- Kimchi: This traditional Korean side dish, made from salted and fermented vegetables like napa cabbage or Korean radish, has seen an 80 percent increase in cases in the U.S. compared to last year, making it the top-growing vegetable with over 10,000 cases.

- Korean Sauces: Korean flavors are increasingly present on foodservice menus, with notable growth in Korean BBQ Jerky Sauce (+80 percent), Spicy Korean Sauce (+29 percent), and Korean Hot Sauce (+23 percent) over the past year.

- Dalgona Coffee: Originating in Macau but popularized in Korea during the pandemic, this whipped coffee was named “dalgona” by actor Jung Il-woo on a Korean TV show.

- Bubble Tea: Originally from Taiwan, bubble tea has become popular in Korea and is growing rapidly in the U.S., with several chains offering bubble tea alongside their corn dog menu items. Bubble tea has seen a 32 percent growth in locations and a 387 percent increase in cases compared to the previous year.

As the U.S. continues to diversify, Circana anticipates a growing presence of global cuisines, including Korean, as well as diverse flavors and culinary trends in the U.S. foodservice sector.

Food Truck Trends

Business success can come down to many factors, including knowing what to sell! National food truck insurance provider FLIP recently released results from a national survey of food truck operators about key menu trends.

TOP MENU ITEM(S): It’s likely no surprise that French Fries and Burgers come in at No. 1 and No. 2 respectively, appearing on approximately 20 percent of Food Truck menus. However, you may have not expected to find seafood (like poke and shrimp) and vegetarian/vegan options featured in the top 10!

Interestingly, 70 percent of respondents noted that their best selling items have not changed since last year, and 21 percent still say soft drinks are their number one selling drink.

Eating at Home

Rich Products (Rich’s) shared the results of a 2024 back-to-school survey, which highlights a growing preference amongst families for planning quick and healthier meals at home this school year. The survey, which polled parents of children ages 5-17, revealed consumers are shifting to more at-home meal occasions, prioritizing convenience, health and price when it comes to meal preparation. This presents an opportunity for retailers to make at-home meal preparation easier and more affordable for families, as schools across the country move back into session.

Below are some of the key trends identified from Rich’s survey:

Preparation is a Priority: The study found that over 66 percent of parents plan to look for quick meal solutions more often and conduct more meal planning. A quarter of consumers looking for quick meal solutions also say they’re planning to buy more hot or prepared foods while grocery shopping, which further emphasizes growing demand for easy at-home meal solutions. According to Datassential, consumers at large have shifted back to planning meals in advance, reporting that 71 percent of consumers say they have planned their most recent at-home meals in advance – a 10 percent increase from 2021.

Finances are in Focus: The current state of the economy is impacting parents’ plans for back-to-school meal preparation. Forty-one percent of survey respondents plan to do more shopping at warehouse club stores this school year to take advantage of value packaging sizes, and 70 percent claimed they are on the lookout for more deals and coupons.

Consumers are Health Conscious: Despite increased demand for quick meal solutions, healthy options remain a priority. More than half (54 percent) of parents cited a desire to prepare healthier and better-for-you foods this school year. Households that plan to eat healthier are also significantly more likely to increase their meal planning (81 percent) and increase their shopping at club stores (51 percent).

Rise in At-Home Dining: Due to the increased emphasis on health and finances, the poll concluded that parents are prioritizing at-home meal preparation this school year. Forty-two percent of parents cited an expectation to prepare breakfast for their children at home more frequently, and 32 percent plan to cut back on takeout and delivery. Additionally, 50 percent of respondents plan to dine less at restaurants, and 41 percent reported that their family will eat less fast food.

Foodservice Packaging Forecast

A recent industry report by Fact.MR estimates the global foodservice packaging market size to be valued at US$ 67.9 billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 6 percent, reaching US$ 121.7 billion by 2034.

Due to shifting customer preferences and the ever-changing demands of the food sector, the market has experienced substantial development and evolution. This market includes a broad range of packaging options made to specifically address the need of different foodservice businesses, such as cafes, restaurants, fast-food outlets, and catering services.

The need for easy and environmentally friendly packaging solutions is being driven by the growing trend of on-the-go dining and the expansion of online food delivery services. As environmental concerns have grown, sustainable packaging materials—such as compostable and biodegradable options—have become more popular.

Advancements in packaging technologies, such as barrier coatings and intelligent packaging, are contributing to the market’s expansion. The global foodservice packaging market is characterized by a competitive landscape where key players are focusing on innovation, product differentiation, and sustainability to gain an edge.

Key Takeaways from Market Study:

- The global foodservice packaging market is forecasted to expand at a CAGR of 6 percent through 2034.

- Global sales of foodservice packaging products are estimated at US$ 67.9 billion in 2024.

- The market is projected to reach US$ 121.7 billion by 2034-end.

- The North American market is projected to expand at a CAGR of 6.1 percent through 2034.

- Polyethylene terephthalate is estimated to account for 29.9 percent market share in 2024.

- East Asia is projected to account for 20.3 percent of the global market share by 2034.