The battle over consumer spending on food and household items continues to heat up and big-box retailers may be taking more market share from dollar stores across several categories.

What Happened: Discount retailer Dollar General Corp DG recently reported second-quarter financial results that saw revenue and earnings per share both miss estimates from analysts.

The company also lowered its full-year revenue and earnings per share outlook as the company may be losing market share to larger competitors Walmart Inc WMT and Target Corp TGT.

Dollar General was asked about competition during its second-quarter conference call.

“We fundamentally don’t believe at all that the model is structurally challenged. But there are challenges to the business as this quarter indicated,” Dollar General CEO Todd Vasos said.

Vasos said the company is gaining market share from new store openings. The CEO brushed off concerns of competition and placed the blame on the weaker than expected quarter on the financial constraint of the company’s core customer who makes under $35,000 annually.

“What we also saw was that while we’re not losing share, we’re actually gaining share against all classes of trade in the consumable realm.”

Vasos said the company is not seeing any competitor take Dollar General’s core customer.

“We continue to feel very good about our everyday low-price position relative to competitors and other classes of trade.”

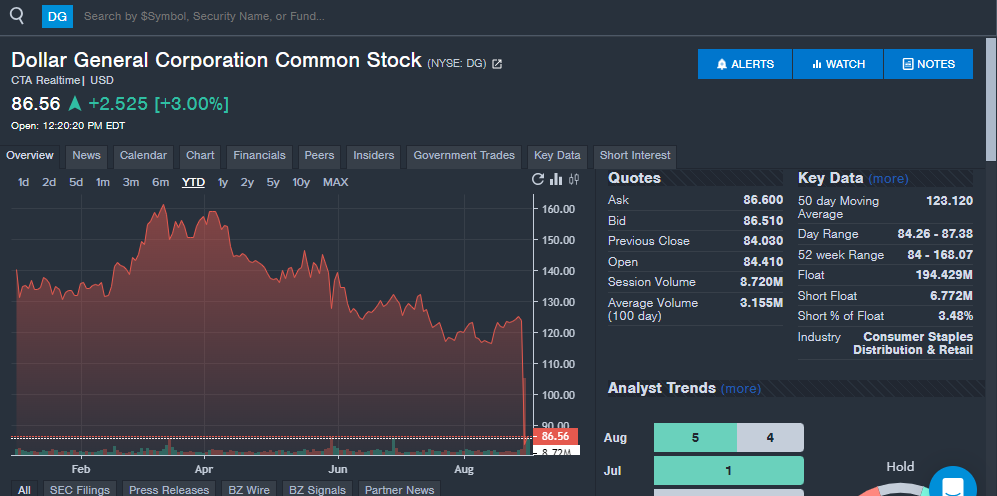

Dollar General shares trade at $86.43 versus a 52-week trading range of $83.76 to $151.22. Dollar General stock is down 38.5% year-to-date as seen on the Benzinga Pro chart below.

Read Also: Dollar General Says Majority Of People Who Shop There ‘Feel Worse Off Financially’ Compared With 6 Months Ago Amid Price Hikes, Softer Employment Levels

Walmart, Target Winning: Walmart and Target have both recently reported financial results and shown strength of consumer spending.

Walmart beat revenue and earnings per share estimates from analysts. The company also raised full year financial guidance. Walmart reported a 4.2% increase in U.S. same store sales.

Several analysts highlighted the results showing Walmart winning market share across multiple income levels, which could indicate taking market share from the core dollar store customer.

Target also beat revenue and earnings per share estimates from analysts in its recently reported quarter.

Both Walmart and Target have expanded their product assortments and are focusing on the consumer who continues to be impacted by above average inflation. Both retailers are leaning into private label brands that have cheaper price points and on expanding lower cost options across a variety of product categories.

While Dollar General isn’t worried about competition, the results from Walmart and Target might say otherwise.

Walmart shares trade at $76.59 versus a 52-week trading range of $49.85 to $76.75. Walmart stock is up 44% year-to-date in 2024.

Target shares trade at $152.77 versus a 52-week trading range of $102.93 to $181.86. Target stock is up 7% year-to-date in 2024.

Dollar Tree Up Next: Discount retailer Dollar Tree Inc DLTR, which owns the namesake Dollar Tree brand along with Family Dollar, could continue to illustrate the market share losses for dollar stores to big-box retailers.

Dollar Tree reports second-quarter financial results on Wednesday, Sept. 4. Analysts expect the company to report earnings of $1.04 per share and revenue of $7.49 billion according to data from Benzinga Pro.

The company reported earnings of 91 cents and revenue of $7.33 billion in last year’s second quarter. Analysts see both figures increasing for this year. The earnings report could show whether Dollar Tree is seeing increased competition from other retailers.

Investors and analysts may pay particular attention to the conference call when questions about competition could come up. The company’s commentary on market share, competition and core customers could show whether Walmart and Target are major concerns for the retailer.

Dollar Tree has missed earnings estimates from analysts in three of the last five quarters and beat revenue estimates in three of the last five quarters.

Dollar Tree shares trade at $84.29 versus a 52-week trading range of $83.76 to $151.22. Dollar Tree stock is down 41% year-to-date in 2024.

Read Next:

Inflation Is Eating Into Sales Of Companies Across The Board, Even This Household Food Name

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.