It’s a tale as old as time. Someone attempts to time the market, only to fail miserably.

Then they either miss out completely, or chase an opportunity that is no longer there and perhaps overpay in the process.

Recently over dinner, a friend told me a story that seemed worthy of sharing.

It had to do with two families who sold their townhomes, but only one purchased another property, while the other rented.

And guess what. Nearly five years later, the renter is still renting.

It’s Never Easy to Get the Timing Right, Especially with Real Estate

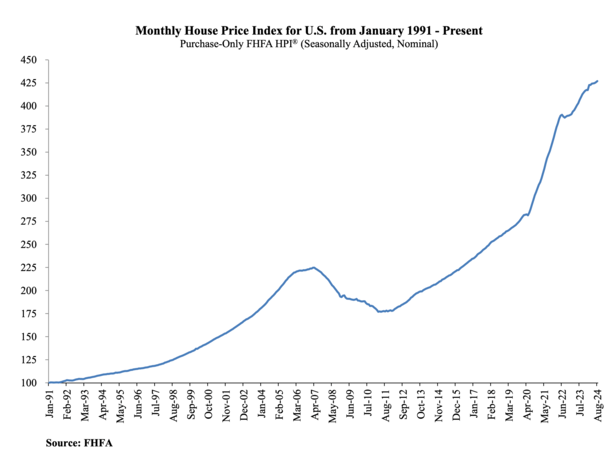

The year is 2019. The housing market had seen some pretty impressive gains since bottoming around 2012 (see this chart from the FHFA for more on that).

Home prices had doubled in a lot of markets nationwide. For sellers, it seemed like a pretty great time to cash out and move on.

Of course, if you were selling a primary residence, you still needed new accommodations. This meant either renting or buying another home.

A friend of mine had his first child and was expecting a second. Like many young families, they had purchased a smaller townhome to get their feet wet.

But it was now time to find a larger space, and make a move from an urban area to a more suburban setting to raise their family.

The good news was their townhome had increased in value tremendously since they purchased it.

This meant a good chunk of sales proceeds and an easy sale, with inventory low and properties in high demand at the time.

It also meant finding a replacement property, which was no small feat for the same reasons.

Fortunately, they were able to land a good deal on a single-family home in a desirable area close to their in-laws within a good school district.

Meanwhile, their old neighbors who lived in the same area also sold their townhome. But instead of buying a replacement, they chose to rent in the suburbs.

The husband told my friend that he was “going to wait for home prices to come down,” given how much they had risen.

Now I don’t fault the guy. I remember how prices felt frothy even back then, before they increased another 50% during the pandemic.

But banking on a price reduction and choosing to rent also came with a lot of uncertainty.

Home Prices Rarely Fall

The issue with the “wait for prices to come down” approach is that they rarely come down.

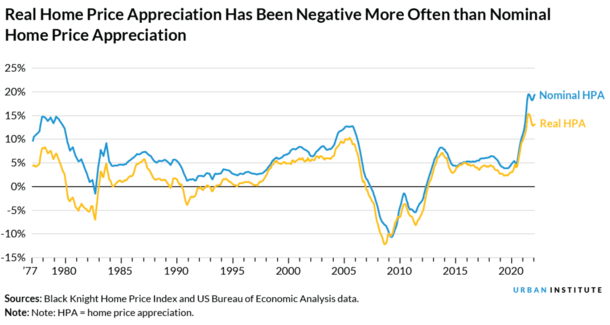

It’s not to say they never come down, but home prices are pretty sticky. There have only been a handful of times when they’ve fallen on a nominal (non-inflation adjusted) basis.

They fallen more in real terms, but even then, it’s been a pretty rare occurrence. Either way, home buyers don’t look at home prices in real terms.

The prices they see on listings are nominal. In other words, if the price was $500,000, and is now $450,000, they’ll see them as falling.

If they were $500,000, and are now $505,000, but inflation makes that $505,000 really worth something like $495,000, it doesn’t provide much relief to the prospective buyer. It’s still higher in their eyes.

Problem is some folks have recency bias thanks to the early 2000s mortgage crisis when home prices plummeted. And they think it can happen again. It might, but again, it’s not common.

Now back to the story. The guy decides to rent while my friend purchased a new home. This was in 2019.

Since then, my buddy’s home has soared in price, up more than 50% because he got a good deal and had to do some work to the place.

He also got a 30-year fixed mortgage rate in the high 2s so his monthly payment is pretty dirt cheap, even though he bought when “prices were high” in 2019.

The other guy is still renting, nearly five years later. And guess what? The rent ain’t cheap. So it’s not like he scored a major discount in the process.

Know what else isn’t cheap? Mortgage rates. Or home prices. Yikes!

If the Renter Buys Now He’ll Feel Like He’s Overpaying

So the guy who is still renting tried to time the market. And it didn’t go well, at least with the benefit of hindsight.

There’s nothing wrong with renting, but this particular family does not want to rent. They want to own a home.

Especially since they have children in local schools and desire stability and peace of mind.

The issue now is that the home purchase has fallen even further out of reach, thanks to higher home prices and much higher mortgage rates.

For example, the $500,000 home in 2019 might be closer to $750,000 today. And the mortgage rate 6.75% instead of 3%.

That would increase the mortgage payment by roughly $2,200 per month, assuming a 20% down payment. Not to mention the larger down payment required.

Even if he could still afford it, the guy probably has a lot reservations since he balked when it was significantly cheaper to buy.

To that end, he’s probably going to continue to time the market and wait for a better opportunity. One that may never come.

Read on: Time Heals All Real Estate Wounds If You Let It